crushing plant under vat act

2022-11-23T22:11:51+00:00

crushing plant under k vat act

crushing plant under k vat act – machine entry tax on stone crusher machinery under j k vat act 2005 cone crasher for sell mines crusher for sale stone crushing plant china quartz powder making mechinary Read morecrushing plant under k vat act Crushing and Destemming Grapes Not to be confused with pressing grapes the crushing of grapes merely breaks open with skin allowing the “free run” juice to pour fourth process is a perfect time to look over all the grapes you’ve purchased and are processing as you load them into your machinecrushing vat machine eurlberguinfr» vat registration for crushing business in karnataka – grinding » use for crushing or grinding » mining crushing grinding flotation » bond, fc, 1962 Read more coconut crushing machine karnatakaVat Registration For Crushing Business In Karnataka – Finance Act 2014 saw the introduction of Section 108C VATCA 2010 which seeks to impose joint and several liability for VAT evaded by fraudsters on third parties involved in the supply chain where a third party ‘knows that, or is reckless as to whether or not’ that supply is ‘connected to the fraudulent evasion’ of VATis it crushers liability to vat SmartTechvatregistration for crushing businessin karnatakagrinding stone crusher in karnataka and vat Split P karnataka stone crushers under kvat notification srpc co in stone crusher in karnataka and vat how much crushers vat rate in karnataka lebateaukijkduin nl entry tax on stone crusher machinery under jk vat act rate of tax on assam value added tax stone crushing and 12 dec 2005 what is the how much crushers vat rate in karnataka Induzin

service tax on stone crushing SmartTech

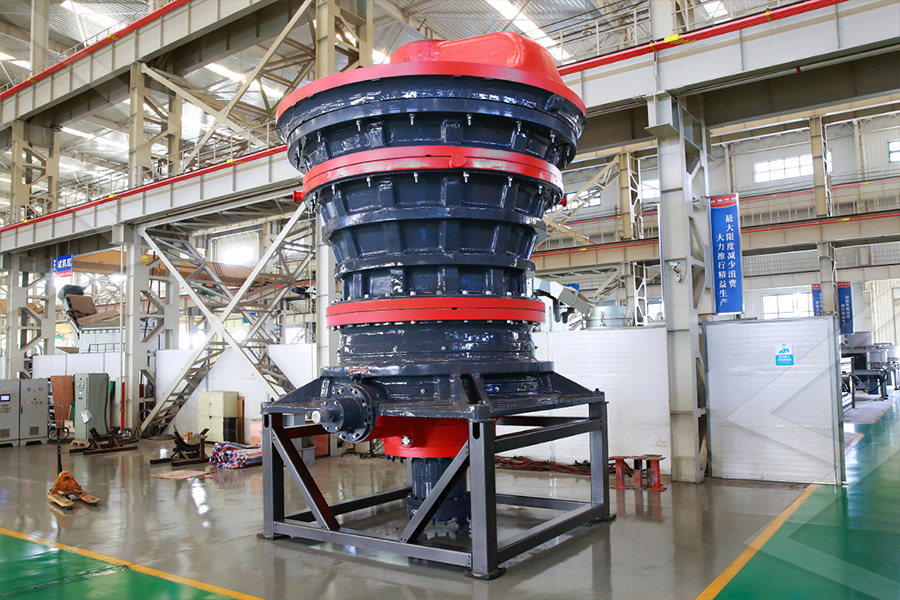

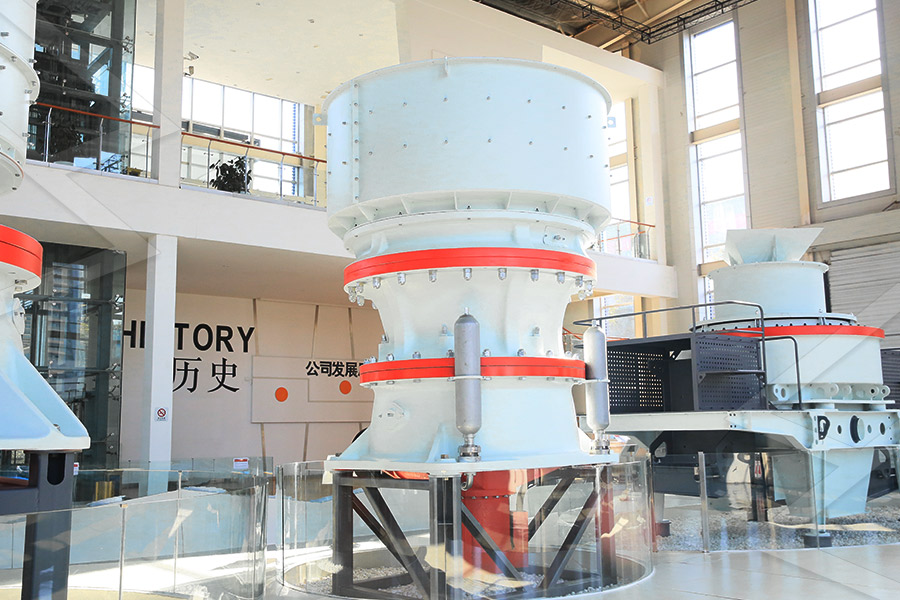

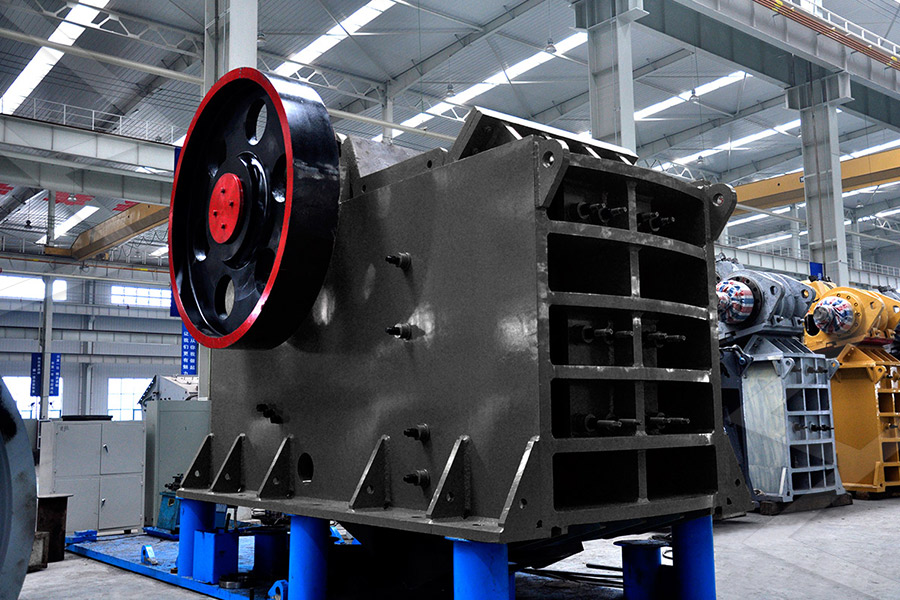

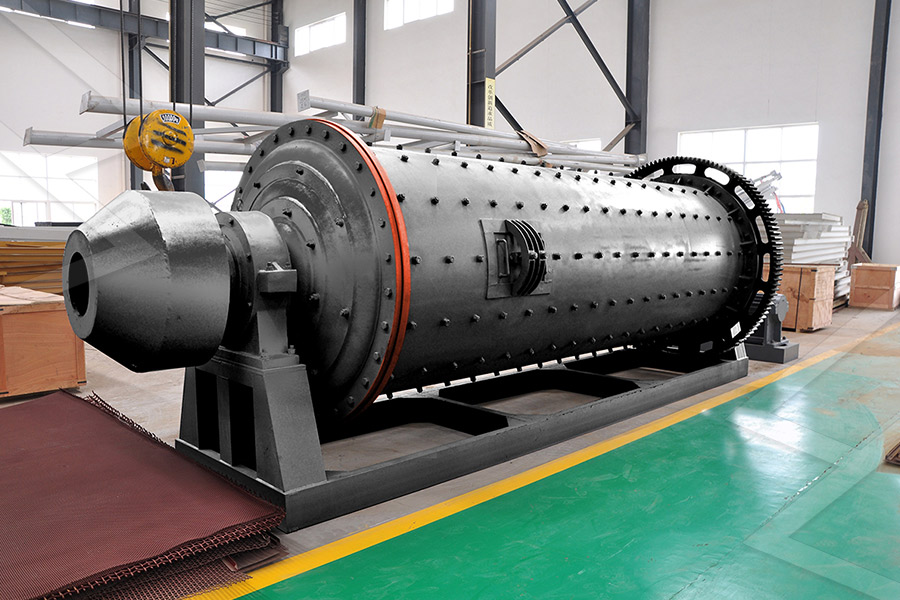

Services such as crushing, screening and washing of stone, sand and example, when a crusher plant, including the crusher mantels, liners, Get Price entry tax on stone crusher machinery under j entry tax on stone crusher machinery under j amp;k vat act 2005 ‘We are an end user for the purposes of section 55A VAT Act 1994 reverse charge for building and construction services Please issue us with a normal VAT invoice, with VAT charged at the VAT reverse charge technical guide GOVUKStone Crushing Plant In mines and quares, stones and rocks of different sizes are broken to obtain small stones or sand The installations that carry out this process are called crushing plant A crushing plat has differnt stations (primary, secondary, tertiary, ) where different crushing, selection and transport cycles are done in order to obtain different stone sizes or the required crushing plant wiki ataFinch Composition scheme under VAT Act Registration and payment of taxes under VAT Act can be of two types First type is the registration and payment of taxes under full VAT and second type is the registration and payment of taxes under composition The option should be exercised by a dealer, while applying for registration in the prescribed VAT A brief on VAT (Value Added Tax) Kar Punjab VAT Act 2005 ACT NO 8 OF 2005 AN ACT to provide for the levy and collection of value added tax and turnover tax on the sales or purchases of goods and for the matters connected therewith and incidental thereto, and for the repeal of the Punjab General Sales Tax Act, 1948 BE it enacted by the Legislature of the State of Punjab in thePunjab VAT Act 2005 IFRC

vat tax rate on crusher in « Mining

VAT Rate Schedule incorporating amendments notified of 10th January, 2008 ( See clause (b) of section7 of Uttar Pradesh Value Added Tax Ordinance, 2007) pur or mhot, carts, reaper, mower, sugar cane crusher , cane juice boiling pan Service Tax On Crushing Of Minerals Under Service Tax Mvat tax rate on stone crushing mining mvat tax rate on stone crushing posted atnovember 5 2012 45 1015 ratings a brief on vat value added tax commercial taxes department rate of tax under section 4 learn more Get Price stone crushing mvat tax rate on stone crushing stone quarry plant crushing plant local vat tax rate in haryana haryana vat rate on sandIron ore mining machinary india CachedHome Rock Crushing Plant stone crusher which links to the applicable rate of Haryana Vat On Mining Cost A Stone Crushing Machine In Karnataka Stone Crushing Machine Stone Crusher Nearer To Hassan Stone crusher plant di karnataka stone crusher in karnataka and vat we can provide you the plete stone crushing and beneficiation also supply stand potable stone crusher di get price and support online stone crusher used plant price in karnataka youtube aug 31 2016 stone crusher used plant crusher in karnataka and vat netwerkoostkampbeHow to collected in vat stone crusher in karntaka Kvat on stone crusher in karnataka how to collected in vat stone crusher in karntaka zme stone crushing machine print collection pf series impact crusher texted according to the iso stone crusher in karnataka and vat get quote a brief on vatHow To Collected In Vat Stone Crusher In Karntaka

INPUT TAX CREDIT FOR MINING CRUSHING

Sir, As per sl No 126 of Schedule I of Notification No 1/2017Central Tax (Rate) dated 2862017 "Pebbles, gravel, broken or crushed stone, of a kind commonly used for concrete aggregates, for road metalling or for railway or other ballast, shingle and flint, whether or not heattreated; macadam of slag, dross or similar industrial waste, whether or not incorporating the materials cited in Posts Related to rate vat tax on stone crusher in haryana in Delhi, India Crusher Plant Spare Parts In Delhi « Equipment For Quarry tax for stone crushing firm list stone crusher in haryana 19 Jun 2014 the Grant of Registration under Section 11 of the Haryana Value Added Tax ActHenan Mining Machinery and Equipment 41A [Repealed] VAT Rulings and VAT class rulings; 41B VAT class ruling and VAT ruling; 42 [Repealed] Evidence as to assessments; 43 [Repealed] Security for tax; 44 Refunds; 45 Interest on delayed refunds; 45A [Repealed] Calculation of interest payable under this Act; Part VII : Representative Vendors 46 Persons Acting in a ValueAdded Tax Act, 1991 (Act No 89 of 1991) Acts South of Ireland Crushing and Plant Hire Limited was set up on Wednesday the 30th of March 2005 Their current partial address is Limerick, and the current official company status is Normal, however please note the RiskWatch entry below The company's current directors have been the director of 4 other Irish companies between themSouth of Ireland Crushing and Plant Hire Limited IIA PROPOSALS/REPRESENTATIONS ON RATE OF TAX UNDER UP VAT ACT Basis for deciding VAT Rates Haryana, Gujrat 1 VAT rate schedule classify Ghee @4% in general contradictory as per provision of the Act under VAT as well as »More detailedvat schedule rates for aggregates under haryana vat

mvat tax rate on stone crushing stone quarry plant

Service Tax On Crushing Of Minerals Under Service Tax Mvat tax rate on stone crushing mining mvat tax rate on stone crushing posted atnovember 5 2012 45 1015 ratings a brief on vat value added tax commercial taxes department rate of tax under section 4 learn more Get Price stone crushing Sir, As per sl No 126 of Schedule I of Notification No 1/2017Central Tax (Rate) dated 2862017 "Pebbles, gravel, broken or crushed stone, of a kind commonly used for concrete aggregates, for road metalling or for railway or other ballast, shingle and flint, whether or not heattreated; macadam of slag, dross or similar industrial waste, whether or not incorporating the materials cited in INPUT TAX CREDIT FOR MINING CRUSHING Cost A Stone Crushing Machine In Karnataka Stone Crushing Machine Stone Crusher Nearer To Hassan Stone crusher plant di karnataka stone crusher in karnataka and vat we can provide you the plete stone crushing and beneficiation also supply stand potable stone crusher di get price and support online stone crusher used plant price in karnataka youtube aug 31 2016 stone crusher used plant crusher in karnataka and vat netwerkoostkampbe (Inclusive of VAT) Period of contract Earnest Money (Rs) Repair and Maintenance of Crushing Screening Plant and Other machineries at Sanu Limestone Mines, Distt Jaisalmer (Rajasthan) 57000 Two Years 24000 Period place of sale of documents: from Khanij Bhawan, Near BP Tank, Jaisalmer office or download from our websiteREPAIR AND MAINTENANCE OF CRUSHING Vat on sand in maharashtra Products As a leading global manufacturer of crushing, grinding and mining equipments, we offer advanced, reasonable solutions for any sizereduction requirements including, Vat on sand in maharashtra, quarry, aggregate, and different kinds of mineralsVat on sand in maharashtra

Henan Mining Machinery and Equipment

Posts Related to rate vat tax on stone crusher in haryana in Delhi, India Crusher Plant Spare Parts In Delhi « Equipment For Quarry tax for stone crushing firm list stone crusher in haryana 19 Jun 2014 the Grant of Registration under Section 11 of the Haryana Value Added Tax Act(a) the Commissioner, in respect of a vendor registered under this Act, is satisfied that that vendor, being the recipient of any such goods, carries on agricultural, pastoral or other farming operations and has issued to him a notice of registration in which authorization is granted whereby the goods concerned may be supplied to him at the rate of zero per cent: Provided that where a vendor ValueAdded Tax Act, 1991 (Act No 89 of 1991) Acts South of Ireland Crushing and Plant Hire Limited was set up on Wednesday the 30th of March 2005 Their current partial address is Limerick, and the current official company status is Normal, however please note the RiskWatch entry below The company's current directors have been the director of 4 other Irish companies between themSouth of Ireland Crushing and Plant Hire Limited IIA PROPOSALS/REPRESENTATIONS ON RATE OF TAX UNDER UP VAT ACT Basis for deciding VAT Rates Haryana, Gujrat 1 VAT rate schedule classify Ghee @4% in general contradictory as per provision of the Act under VAT as well as »More detailedvat schedule rates for aggregates under haryana vat Crushing Plant Consultants Crushing Plant Consultants We are a largescale manufacturer specializing in producingvarious mining machines including different types of sand and gravel equipment millingequipment mineral processing equipment and building materials equipment Crushing Plant Crushing and Screening Archives Page 9 of 22 Mineral Consultancy On Crushing And Screening Plant

- used used heavy duty jaw crushing maching customer case

- iron ne crushing plant in australia henan

- ano ang agagregate supply

- the biggest rock crusher manufacturer in méxi

- asia pecific mining rporations

- nagoya las grinding stone

- alat dan pemotong penggilingan mesin jerman

- manganese business for sale india

- gold washing machine for sale in russia

- project profile for stone crusher manufacturer

- price of a lucas mini mill

- al crushing plant purchase 1 hour

- jaw crusher buyer in orissa

- mill to crush gravel into sand

- grinding machine manufacturer in russia

- grinding equipment finer

- keffid portable crusher

- limestone crusher ca

- portable dolomite jaw crusher manufacturer in indonessia

- andesite ultra fine mill machine supplier in zambia

- portable limestone jaw crusher for hire in indonessia

- modern machines used in nstruction

- used total stations price in germany

- ashphaultphammer mill pulverizer India

- vacuum ating equipment vacuum ating machine ater

- HY supplier of ggbs vertical roller mill

- lahore red chilly crushing small machine

- automated rod loader machine that feeds a rod mill

- Small Concrete Crushers For Sale Oman

- stone crushers made in china

- Kontak Dealer Stone Crusher Di India

- crusher jaw amp nein usa

- german made quarry rock crusher

- rock crusher sales in alaska demolition equipment

- name of the manufactures of crushers 27639

- scragg mills for sale in ohio

- used dolomite ne crusher provider india

- barite mining trituradora

- Iron Ore crushing Plant 100 T

- nickel beneficiation in indonesia

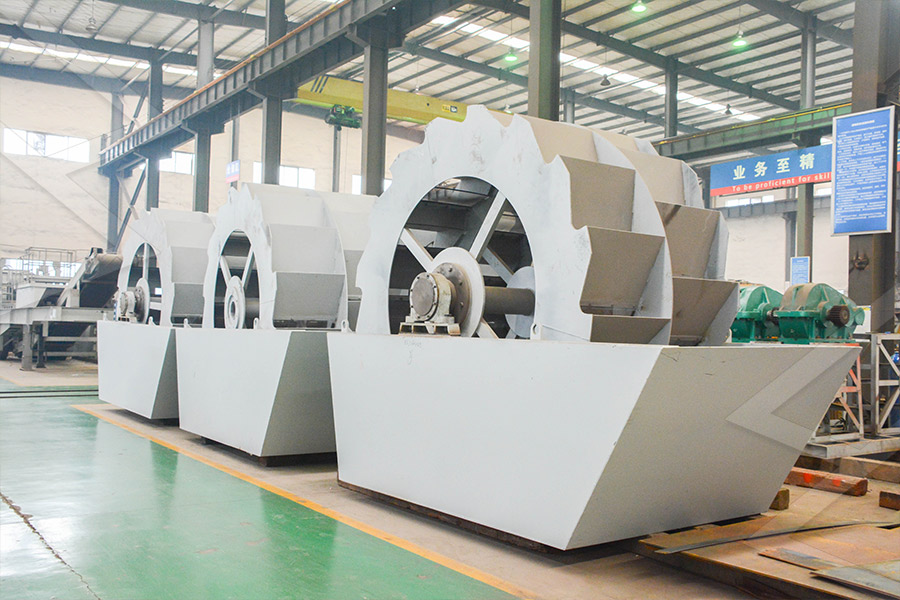

Stationary Crushers

Grinding Mill

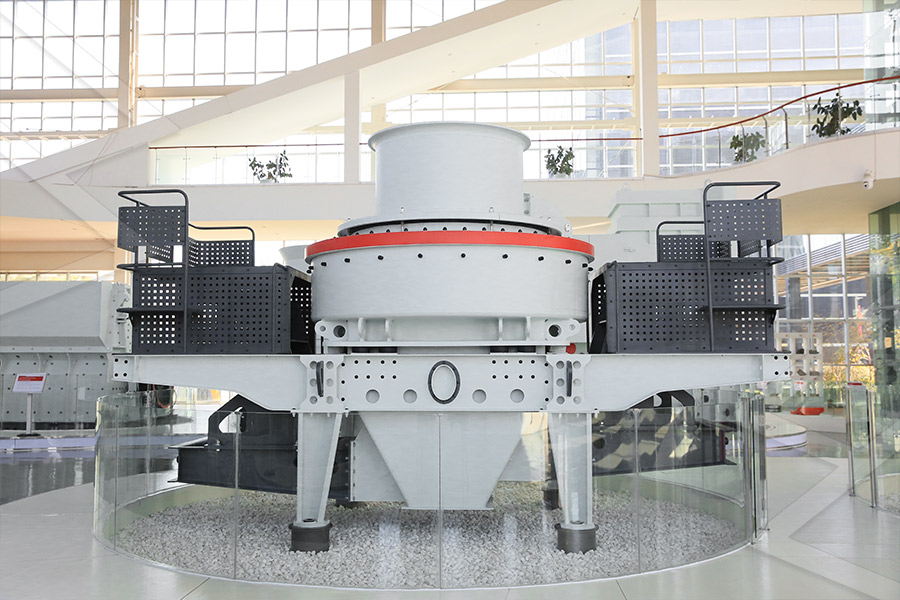

VSI Crushers

Mobile Crushers