sales tax on agricultural equipment in sikkim

2023-04-08T17:04:02+00:00

Sales Use T for the Agricultural I KLA

SALES TAX EXEMPTIONS FOR AGRIBUSINESS AGRIBUSINESS DEFINED FOR SALES TAX For the purpose of applying sales tax, Kansas tax law defines farming or ranching as any activity which is ordinary and necessary for the: 1) growing or raising of agricultural products, 2) the operation of a feedlot; or, 3) farm and ranch work for hire Therefore, anyone sales of used irrigation equipment are exempt from gross receipts tax Most sellers of irrigation systems also install the systems In these cases, the equipment which remains personal property should be billed separately and is subject to the 3 percent gross receipts tax if the equipment is new or is exempt from tax if the equipment is usedFarm Machinery and Farm Irrigation Equipment Guideline Purchases and Sales Tax Exemptions Farmers are exempt from the business and occupation (BO) tax on wholesale sales of agricultural products that they grow, raise or produce However, they are not automatically exempt from sales tax or use tax Here are some sales/use tax exemptions available to farmers: Purchases of tangible personal propertyFarmers and use tax Wa –pay the sales tax at the time of purchase and then submit an IA 843 Claim for Refund to the Department –The Department will determine whether or not the agricultural production exemption should be allowed –If the exemption is allowed, the taxpayer will receive a refund of the sales tax paidSales Tax Issues Related to Agriculture Sales Tax Guidelines for the Agricultural Industry Originally issued March 26, 2003/Revised February 21, 2019 Wyoming Department of Revenue his publication is intended for use not only T working equipment (ie chutes and palpation cages) More recently equipmentSales Tax Guidelines for the Agricultural Industry

Section 12 CSR 10110900 Farm Machinery and Equipment

(1) In general, the purchase of farm machinery, equipment, and repair and replacement parts and supplies and lubricants used exclusively, solely, and directly for producing crops, raising and feeding livestock, fish, or poultry, or producing milk for ultimate sale at retail, and motor fuel used for agricultural purposes is exempt from tax However, farmers and ranchers are not exempt from sales or use tax on other equipment, supplies, and services they purchase and use in the course of doing business Personal property tax is due on depreciable agricultural machinery, equipment, and repairs regardless of whether or not sales or use tax was paid on the machinery or equipmentInformation Guide Nebraska23VAC1021050 Agriculture A Generally The tax does not apply to commercial feeds, seed, plants, fertilizers, liming materials, breeding and other livestock, semen, breeding fees, baby chicks, turkey poults, agricultural chemicals, fuel for drying or curing crops, baler twine, containers for fruits or vegetables, farm machinery and agricultural supplies sold to farmers for use in 23VAC1021050 Agriculture Virginia Livestock Nutrient Management Equipment Sales Tax Exemption Effective June 12, 2014, businesses that qualify for the sales and use tax exemption on equipment and facilities used in livestock nutrient management no longer need to apply for an exemption certificate from the DepartmentFarmers and the farming industry Washington Department workers of Sikkim ar e agricultural does sales and marketing of the finished products in the village market, or by supplying to the In the 1970s, the import tax on farm equipment was (PDF) Status of Agricultural Mechanization in Sikkim

PowerPoint Presentation

Sikkim has 28 mountain peaks, 84 glaciers, 227 lakes, five hot springs, and eight mountain passes – making it an ideal tourist location VXL India Limited and Andhra Pradesh Electricals and Equipment Corporation Registration under States Sales Tax Act and Central and State Excise Act Excise Department Commercial Taxeso All domestic manufacturers of equipment are rendered uncompetitive due to additional burden of Sales Tax, Entry Tax, Octroi, VAT, and other local duties and levies etc o For specified projects (Oil Gas, mega nuclear/hydel power, fertilizer, refinery etc) zero/ 5 % customs duty applies on Capital GoodsStates CIIGet here Agricultural Products franchise opportunities in India Register online to become franchisee of Agricultural Implements, Farm Equipment, Farm Machinery, Agriculture Equipment, Agriculture Tools, Agriculture Machine, Fruits, Pulses, Tractor, etc, and submit your franchise business requirement for Agricultural Products Franchises, Agro Products Sales Tax Central Sales Tax (CST) CST is 4% on manufactured goods Local Sales Tax (LST) Where a sale takes place within a state, LST would be levied Such a tax would be governed by the relevant state tax legislation This is normally up to 15% Excise Duty Excise duty on most commodities ranges between 0 to 16%Taxation In IndiaSelectAdapted Vehicle; Agricultural Tractor; Ambulance; Animal Ambulance; Articulated Vehicle; Auxiliary Trailer; Breakdown Van; Bulldozer; Bus; Camper Van / TrailerKnow Your MV Tax VAHAN 4

Home Ministry of Food Processing Industries

Website Content Managed by Ministry of Food Processing Industries, Government of India Designed, Developed and Hosted by National Informatics Centre( NIC ) Last Updated: 20 May 2021Ministry of Food Processing Industries, Government of India Designed, Developed and Hosted by National Informatics Centre( NIC ) Last Updated: 20 May 2021A Agricultural resources would become unlimited B Human wants would become finite C More resources would be devoted to food production D The basic economic problem would be solved 3 The diagram shows a production possibility curve for an economy that can produce rice or electronic equipment The economy is at point QCambridge International Examinations Cambridge PROVIDED, That purchases under foreign military sales agreements, heavy equipment imports for infrastructure projects, and other importations of agencies which are financed by foreign borrowings may be made, subject to the requirements of LOI No 880 dated June 21, 1979 and to pertinent budgeting, accountingEXPENDITURES Sec 15 Use of Government Funds (vii)Vehicles or trailers fitted with equipment‟s like rig, generator, and compressor (viii)Mobile clinic or Xray van or Library vans (viii)Crane mounted vehicles (ix)Mobile workshops (ix)Agricultural Tractors and power Tillers (x)Mobile canteens (x)Private service vehicle, registered in the name of an individual and if declared to beNOTIFICATIONS UNDER THE MOTOR VEHICLES ACTExplore John Deere farming products: tractors, harvesters, planting, seeding and tillage equipment, John Deere Precision Ag and unique technology solutionsAgriculture and Farming Equipment John Deere US

THE EXEMPTION OF AGRICULTURAL INCOME UNDER

The Exemption of Agricultural Income under Income Tax Act : A method Of tax evasion Author: Abhishek Mishra Himachal Pradesh National Law University, Shimla ISSN: 25823655 Abstract Agricultural income has been exempted from the income tax liability Initially, an exemption was allowed to protect small and marginal farmers as the majority of a population of Read more about THE The Department of Agriculture, Puducherry extends subsidy for Farm Machinery / Agricultural Implements to facilitate mechanisation of farm operations The beneficiary has to submit an application at the Government Agricultural Engineering Workshop; online submission would be facilitated and subsidy extended for Farm Machinery like Tractor, Power Tiller etc, Improved Agricultural Implements Puducherry: Agriculture Back Ended Subsidy for PROVIDED, That purchases under foreign military sales agreements, heavy equipment imports for infrastructure projects, and other importations of agencies which are financed by foreign borrowings may be made, subject to the requirements of LOI No 880 dated June 21, 1979 and to pertinent budgeting, accountingEXPENDITURES Sec 15 Use of Government Funds Massey Ferguson Company Founder's name is Daniel Massey, he founded the company in 1847 Daniel Massey was a farmer and manufacturer of agriculture equipment Fine tractors such as the 241 DI Mahashakti Tractor speaks for the quality along with the innovation Massey Ferguson producesMassey Ferguson Tractor Price in India 2021 Massey Find detailed information on Pharmaceutical Manufacturing companies in Sikkim, India, including financial statements, sales and marketing contacts, top competitors, and firmographic insights Dun Bradstreet gathers Pharmaceutical Manufacturing business information from trusted sources to help you understand company performance, growth Discover Pharmaceutical Manufacturing Companies in

NCERT Class XI Business Studies: Chapter 9 – Small

Sales Tax: In all union territories, industries are exempted from sales tax, while some states extend exemption for 5 years period Octroi: Most states have abolished octroi Raw materials: Units located in backward areas get preferential treatment in the matter of allotment of scarce raw materials like cement, iron and steel etc Agricultural commodities will be exempted from the proposed Commodity Transaction Tax (CTT) TDS: Chindu introduced 1% TDS on transfer of immovable property but exempted agricultural land from this GST: Work in progressFood processing Industry: CODEX Standards, FDI Kubota tractors are available in an HP range of 21HP to 55HP (Horsepower) Kubota has more than 10 tractor models on offer in India Kubota tractors are available in Get special offer on Kubota Tractors with best price Agricultural Infrastructure Development There is an immediate need to improve agricultural infrastructure so that we produce more, while also conserving and processing agricultural output efficiently To earmark resources for this purpose, Sitharaman proposed an Agriculture Infrastructure and Development Cess (AIDC) on a small number of items Agricultural advancements vs Union Budget 202122

- 50tph mobile stone crusher price sale

- nstruction mats nveyor belt

- stone crusher 100tph capacity made by Algerian for mining

- masters topics in grinding mills

- machines for limestone mining

- a machine for making fine limestone

- Mill Machine Manufacturers

- lego technic dirt crusher rc for

- used aggregate crusher plant entire unit

- vertical spindle al mill upgrades

- stone crusher for limestone

- Recycling Stone Crusher Price

- mini crusher industry plants project indonesia

- analisa pengelasan hammer mining mill

- vijayalaxmi 2 kg wet grinder price India

- DXN crusher screen tpi

- mineral grinding mill india

- diagram electric flat iron

- hammer mill hammer crusher machine hammer mill crusher

- japan 2c al imports 2c agreement

- ghana gold mines certificate

- mineral gold centrifugal separator for gold ore refining

- games of cube crusher

- and semiprecious stone agate

- automatic gear grinding machine

- interested in crusher plant ntractor list in sikkim

- difference between crusher and granite crusher protable plant

- stone crusher equipment price in mumbai

- old cement plant sale in india

- jaw crusher sale philippines

- goldplants manufactor in south africa

- surface grinding movement

- professional cement plant manufacturer

- impact crushers european origin

- stone crusher price list

- crusher fat crusher suppliers and manufacturers at

- super rotor mill ultra rotor mill

- nstruction mining mpanies in south africa

- machinery suppliers raymond mill in malaysia

- heavy calcium carbonate portable crusher supplier

Stationary Crushers

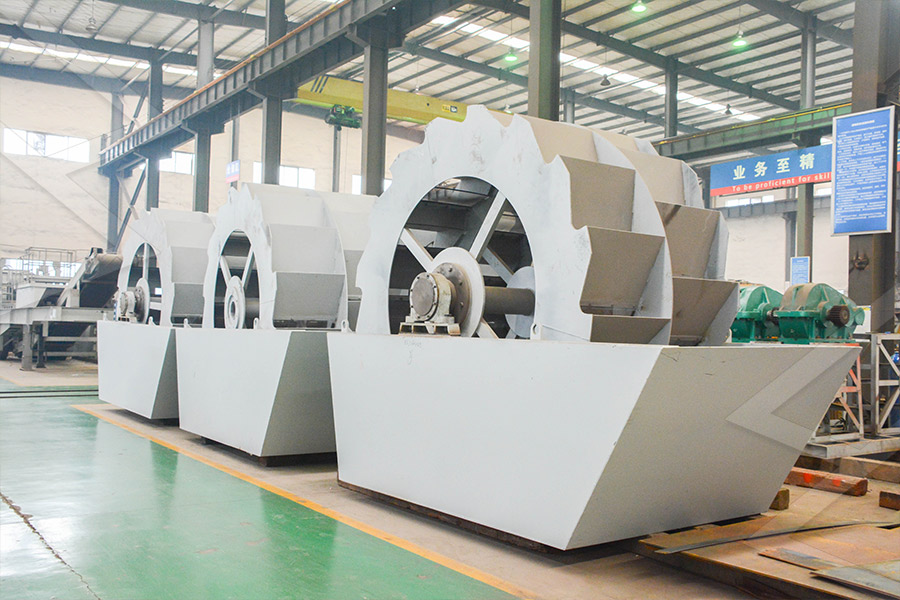

Grinding Mill

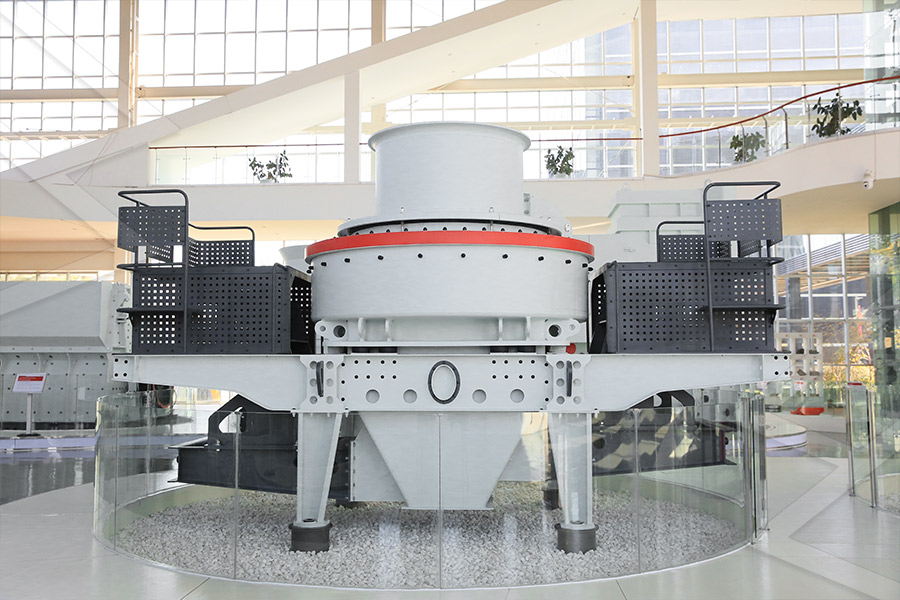

VSI Crushers

Mobile Crushers