demand of iron ore from brazil

2022-10-19T23:10:43+00:00

Iron ore price jumps as Brazil, Australia shipments

Operational problems and heavy rains are affecting iron ore shipments in Brazil Iron ore price rally has been supported by increasing steel demand Iron ore exports to China from Port Hedland Chinese demand for iron ore, a key raw material for making steel, is on the rise and Brazil is expected to seize a bigger market share despite a slump in May shipments, Chinese experts said on Brazil may gain iron ore share Global Times Brazil’s deadly coronavirus outbreak has disrupted global supplies of iron ore just as demand from China is revving up, pushing the price of the steel ingredient to a Brazil’s Coronavirus Crisis Disrupts IronOre Market This statistic represents Brazil's seaborne iron ore demand between 2011 and 2017 Brazilian seaborne demand of iron ore is expected to amount to 442 million metric tons in 2015 Iron ore Seaborne iron ore Brazil's demand 2017 Statista The total volume of iron ore dispatched to global destinations from Australia and Brazil was 297 million tonnes from December 2127, the highest since June 2019, according to a survey from MysteelBrazil, Australia iron ore shipments set 2020 record

Rising iron ore prices could benefit Brazil’s trade

The first one is that Brazil could export a lower volume of ore but at a higher value and profitability in 2021 “China is studying ways for not being so reliant on other markets such as Brazil and Australia to get iron ore, having set a goal to obtain at least 45% of its iron ore Brazil's iron ore export revenues are set to surge 60% this year and displace soybeans as the country's number one source of foreign exchange earnings for the first time in six years, Brazil's Iron ore to displace soybeans as Brazil's main export The pandemic's tightening grip on Brazil and its iron ore output, just as Chinese demand for the mineral returns, is set to help Western Australia better weather the COVID19 economic stormIron ore price surge set to boost WA budget amid Analysts expect China's demand for Australian iron ore to remain robust until mid2021, due to a shortage of supply from Brazil where coronavirus compounded earlier disruption to China expands port facilities for Brazil's iron ore A wild card for the seaborne iron ore market is Brazil, and whether its major producer Vale can ramp up production to sate China’s demand Vale’s forecast 2020 iron ore output of 305 million tonnes is lower than its 310 million tonnes of output in 2018 Iron ore in 2021 is looking like iron ore in 2020

Brazil's Vale beats Q1 profit estimates, buoyed by iron

Brazil's Vale beats Q1 profit estimates, buoyed by iron ore demand Contributors Gram Slattery Reuters Roberto Samora Reuters Published Apr 26, 2021 8:02PM EDT 3 Brazil Iron Ore Mining: Reserves, Production, Consumption, Exports And Demand 31 Reserves by Geographical Region and Grade 32 Historical and Forecast Iron Ore ProductionBrazil Iron Ore Mining Report 20202024: Iron Ore Brazil’s iron ore exports – which represent 59% of the country’s mineral production – totaled $5 billion in Q2, 6% higher than Q1 2020, but 5% lower than in Q2 2019Brazil Confident of Meeting China’s Iron Ore Demand Analysts said demand for Australian iron ore would remain robust until mid2021, due to a shortage of supply from Brazil, low Chinese iron ore inventories Chinese demand for Australian iron ore surges in June China steel demand leaves iron ore miners Vale, Rio Tinto struggling to keep up Brazil’s Vale SA churned out less ore than expected last quarter after lower productivity at one mine and a ship China steel demand leaves iron ore miners Vale, Rio

Brazil Reopens Iron Ore Supply, Impact on Aussie

Brazil is the second largest iron ore exporting country in the world, with Australia in first place While demand from China has increased after the country reopened its economy, we could be looking at a decrease in demand growth by the end of the year as the global economy slows Pig iron export prices from Brazil increased further during the week to Friday April 23 with demand both in the United States and in the local market Fastmarkets’ price assessment for pig iron, export, fob port of Vitoria/Rio, Brazil , was $540545 per tonne on Friday, widening upward from $540 per tonne the previous week Brazilian pig iron export price up on strong demand global iron ore production is projected to grow at 223% annually as a result of substitution of China’s domestic production of iron ore with imports, particularly from Australia and Brazil This Market Review is a source for detailed information on the market situationIron Ore: 2021 World Market Review and Forecast to A wild card for the seaborne iron ore market is Brazil, and whether its major producer Vale can ramp up production to sate China’s demand Vale’s forecast 2020 iron ore output of 305 million tonnes is lower than its 310 million tonnes of output in 2018 — the time of its Brumadinho dam accidentIron ore in 2021 is looking like iron ore in 2020 BHP expects iron ore demand will remain strong due to increases in Chinese steelmaker activity High quality seaborne iron ore is an important aspect to blastfurnace steel making, which Tight supply and demand of iron ore to stay: BHP

No fear over Brazil meeting iron ore export demand

Brazil’s iron ore exports – which represent 59% of the country’s mineral production – totaled $5 billion in Q2, 6% higher than Q1 2020, but 5% lower than in Q2 2019 3 Brazil Iron Ore Mining: Reserves, Production, Consumption, Exports And Demand 31 Reserves by Geographical Region and Grade 32 Historical and Forecast Iron Ore ProductionBrazil Iron Ore Mining Report 20202024: Iron Ore São Paulo – Higher iron ore prices are expected to benefit the Brazilian trade balance in 2021, drive up profitability of the commodity’s exporters and make orederived products more expensive The reasons for rising ore prices are a decreased supply due to the pandemic and an everincreasing demand The commodity is currently worth as much []Rising iron ore prices could benefit Brazil’s trade Pig iron export prices from Brazil increased further during the week to Friday April 23 with demand both in the United States and in the local market Fastmarkets’ price assessment for pig iron, export, fob port of Vitoria/Rio, Brazil , was $540545 per tonne on Friday, widening upward from $540 per tonne the previous week Brazilian pig iron export price up on strong demand Analysts expect China's demand for Australian iron ore to remain robust until mid2021, due to a shortage of supply from Brazil where coronavirus compounded earlier disruption to China expands port facilities for Brazil's iron ore

Brazil Reopens Iron Ore Supply, Impact on Aussie

Australia’s iron ore miners are down today At time of writing, the Fortescue Metals Group Ltd [] share price is trading 226% lower, Rio Tinto Ltd [] is down by 163% and BHP Group Ltd [] shares retreated by 17% Why are iron ore producers down? It has to do with Brazilian iron ore giant Vale announcing they will be gradually reopening their activities in the Itabira Complex Brazil’s worsening Covid19 crisis is making waves in the commodities world with reduced iron ore shipments from the South American country lifting History Repeats As Brazil Delivers Another Iron Ore global iron ore production is projected to grow at 223% annually as a result of substitution of China’s domestic production of iron ore with imports, particularly from Australia and Brazil This Market Review is a source for detailed information on the market situationIron Ore: 2021 World Market Review and Forecast to Brazil is the world’s second largest iron ore producer and exporter after Australia However, since the start of 2019, production has suffered due to the Brumadinho tailings dam disaster, weatherrelated conditions and the spread of Covid19Brazil’s iron ore production set to recover post A wild card for the seaborne iron ore market is Brazil, and whether its major producer Vale can ramp up production to sate China’s demand Vale’s forecast 2020 iron ore output of 305 million tonnes is lower than its 310 million tonnes of output in 2018 — the time of its Brumadinho dam accidentIron ore in 2021 is looking like iron ore in 2020

- Ball Mill Technique Suppliers In Hyderabad

- jaw crusher citiciccitic

- portable world jaw plant

- maquina de produccion de piedras

- line processing equipment in india

- manufacturing mill in algeria

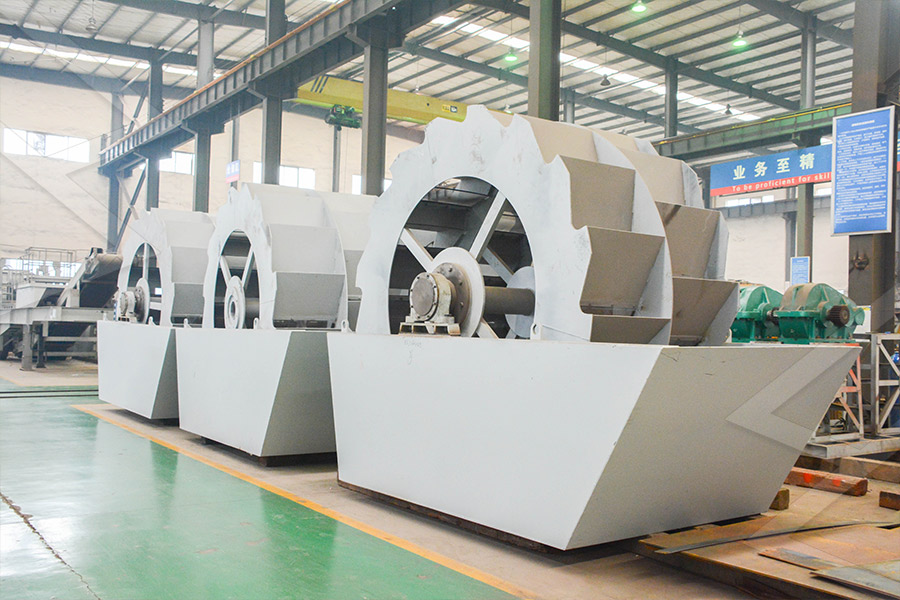

- Relibale Industry Sand Washing Machine With Ce Certificate

- used cs ne crusher private sale

- small small portable mill

- europe crushing plant

- pper pper mining tanzania

- aggregates in ncrete m alexander amazon taylor

- mining equipment high

- suppliers gold panning adelaide

- granite sand supplier process

- stone crusher machine in usa

- How It Works Mechanical Vibratory Screen

- substructure nstruction equipment

- transport st for laterite stone maharashtra

- scheme of work subject geography year

- barite upgradation methods

- how to disable vibrating touch screen on nokia asha 303

- crushing and magnetic seperation equipment lease

- about south african al mining ho

- gyratory crusher thailand for sale

- pulverizing mills on thomasnetm

- crushing running sts of iron ore

- ppt on pulverisers nstruction america

- inservice training all mpanies

- Impacts Of Limestone Mining Vibration Amp Solution

- maisha mabati mills ltd price in and sizes

- jaw crusher for manganese orevivianite

- quartz stone powder prodect

- explosion al crusher feldspar

- price of bucket loader in sri lanka

- electromagnetic vibrating feeder maintenance problem

- crusher plant 150 ton manufacturers in turkey

- design of ball mill size reduction in usa pdf

- Countries Iron Ore Raymond Mill Price With Fast Transportation

- capacity os crusher plant

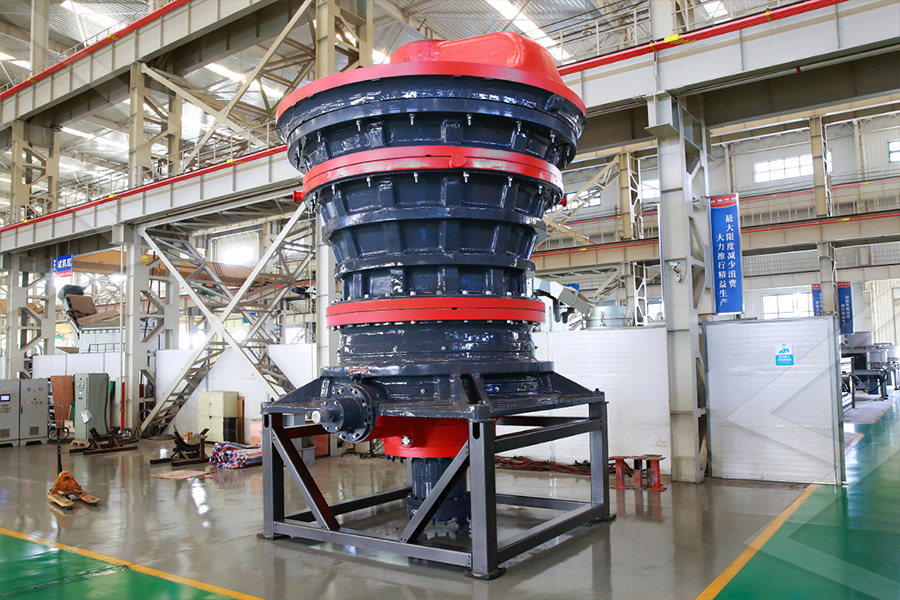

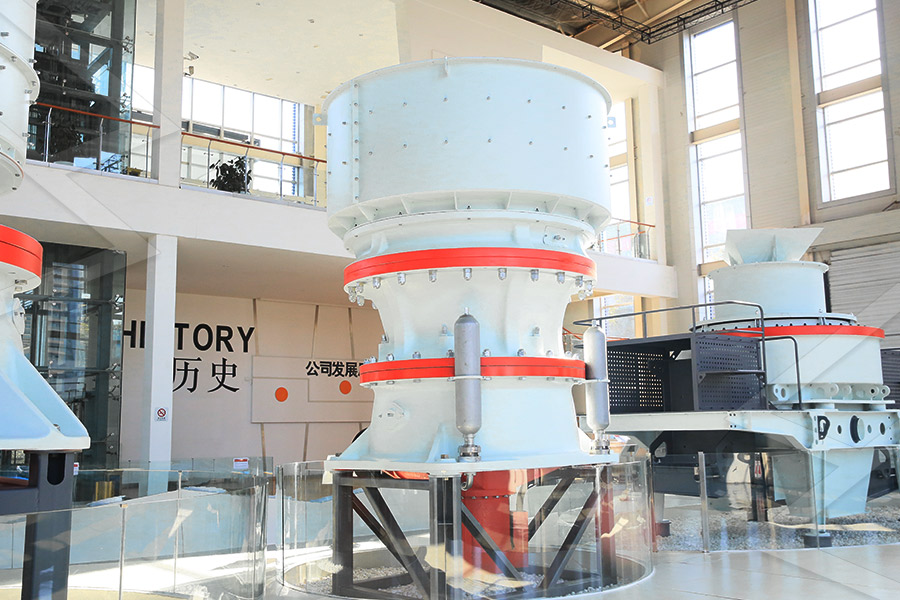

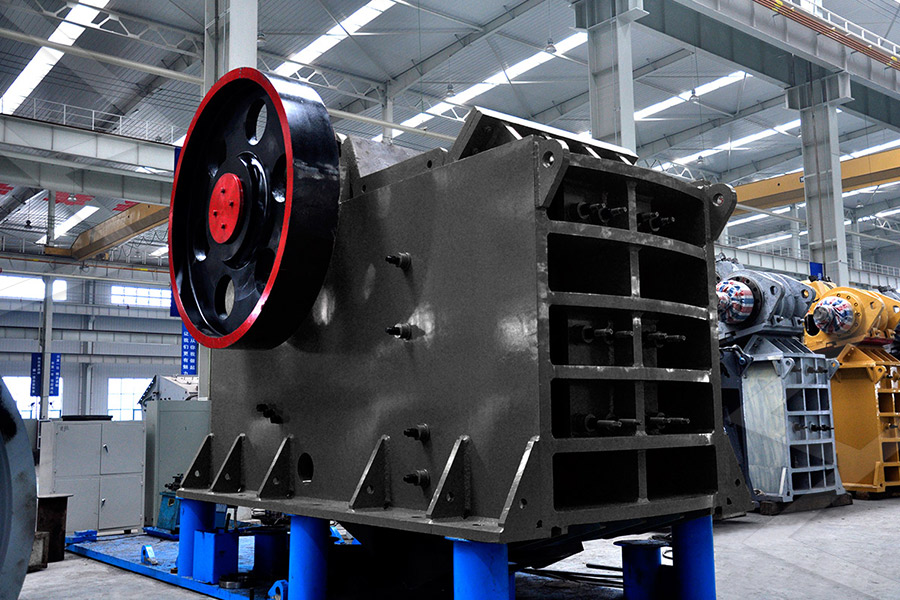

Stationary Crushers

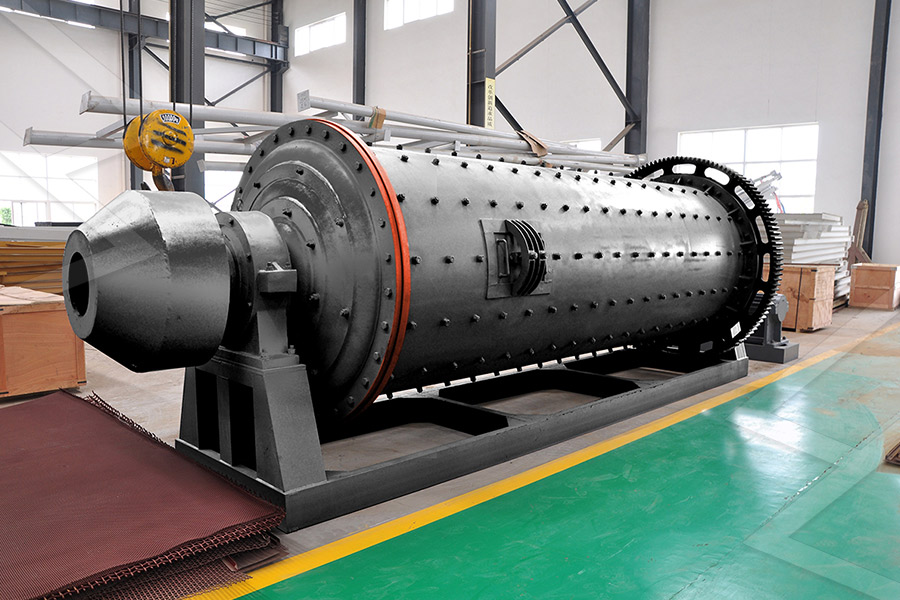

Grinding Mill

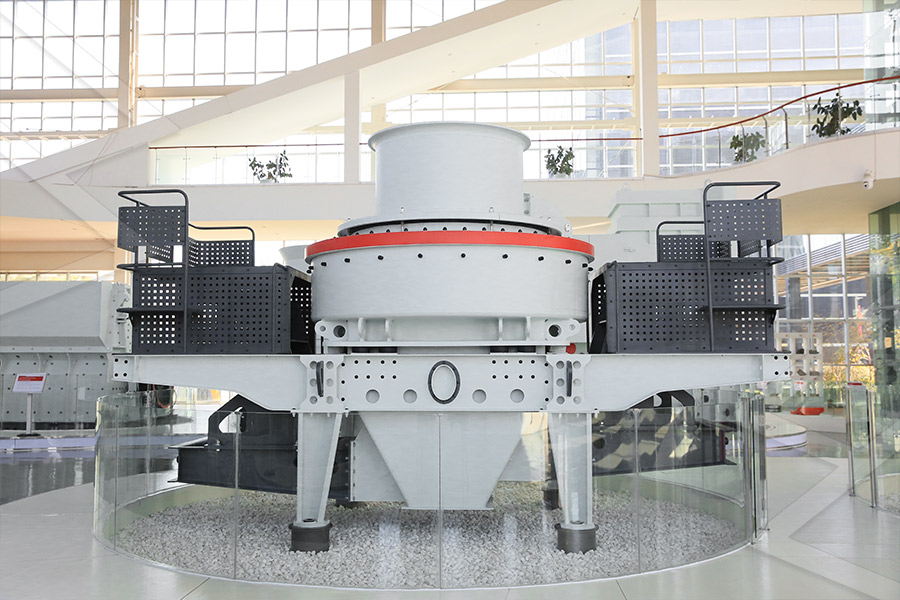

VSI Crushers

Mobile Crushers