service tax on ntract of excavation of stone for c

Service Tax On Contract Of Excavation Of Stone For C

Service Tax On Crushing Of Minerals Under Service Tax; Stone Crush Service; Portable Milling Machine Service In Ontario; Mining Machine Service S A C; Service Engr Jobs Vacancy In Puzollana Mobile Crusher 2013; Service Tax On Contract Of Excavation Of Stone For C; Babcock 85 E9 Ball Mill Service India; Walter Grinding Machines Service Service tax has been imposed on Mining Services ie, services outsourced for mining of minerals, oil or gas by the Finance Act, 2007 as a separate taxable service with effect from a 1st June, 2007 vide Notification No 23/2007ST dated 22052007 The gross amount charged by or gross consideration received by any person being service provider from any other person in relation to TAXABILITY OF MINING SERVICES taxmanagementindia (3) (4) (5) (vii) Composite supply of works contract as defined in clause (119) of section 2 of the Central Goods and Services Tax Act, 2017, involving predominantly earth work (that is, constituting more than 75per cent, of the value of the works contract) provided to the Central Government, State Government, Union territory, local authority, a Governmental Authority or a Government Entity5% GST payable on Earth Work constituting more Tax Guru Earth work in excavation by mechanical means (Hydraulic excavator) /manual means over areas including disposal of 3 graded stone aggregate 20 mm nominal size in slabs cost of centering, shuttering, finishing and Custom duty, Contract Tax, Entry Tax, and Service Tax, freight etc No extra cost will be entertained on account of any Taxes QUOTATION QUOTATION FORFOR CONSTRUCTION OF It is a matter of fact that demand of service tax under impugned order has been confirmed under the category of commercial or industrial construction and work contract service It can be seen that the construction of road and activities in relation to construction of road are exempted from the scope of levy of service taxTpg Construction Ltd v Cst, DelhiI CESTAT

Tax on Royalty payable to State Govt on natural resource

Taxability of Royalty payable to State Government on extraction of natural resource Prior to 1 st April, 2016, “Support services” provided by Government or Local Authority to Business Entities were taxable, as it was specifically excluded from the negative list [Section 66D(a)(iv)] [Section 66D(a)(iv)] “Support Service” had been defined under Section 65B(49) which means: Underground, Inc v Dep’t of Revenue, Arizona Board of Tax Appeals, No 58688S (Jan 26, 1989), decision amended and reh’g denied (Apr 25, 1989), the Board concluded that an excavation contractor was not liable for the sales tax under a contract it had with a sanitary district to dig trenches and install lateral sewer tapsARIZONA SALES TAXATION OF CONTRACTING Steptoe (c) the dimensions and elevations shown on the Drawings 3 Abutments Concrete abutments shall be backfilled with granular material in the areas bounded by: (a) the bottom and side slopes of the excavation under the approach slabs; (b) the wingwalls of the abutment; and (c) the dimensions and elevations shown on the Drawings 4 PiersSPECIFICATIONS FOR SUPPLYING AND PLACING BACKFILL2 天前 Services Accounting Code also called as SAC Code is a classification system for services developed by the Service Tax Department of India Using GST SAC code, the GST rates for services are fixed in five slabs namely 0%, 5%, 12%, 18% and 28%SAC Codes: SAC Code 9954 SAC Code for Job Works 2 天前 Excavation in earthwork for hard soil/ hard rock for a lead distance of 1km for following depths: a) Up to 15m b) 15m to 3m c) 3m to 45m In the above examples of excavation, more number of descriptions are possible with different lead distance and Rate Analysis of Excavation in Earthwork Calculate

5% GST payable on Earth Work constituting more

(3) (4) (5) (vii) Composite supply of works contract as defined in clause (119) of section 2 of the Central Goods and Services Tax Act, 2017, involving predominantly earth work (that is, constituting more than 75per cent, of the value of the works contract) provided to the Central Government, State Government, Union territory, local authority, a Governmental Authority or a Government EntityPURPOSE: This Special Notice describes changes made by 1991 Conn Pub Acts 3, §103 (June Spec Sess) treating as sales subject to the sales and use taxes the following renovation and repair services provided to renovation and repair services provided to residential real property: paving, painting or staining, wallpapering, roofing, siding and exterior sheet metal workSN 9223 Sales and Use Taxes on Certain Renovation Tax preparation services Other accounting services Architectural, Engineering, Related Services Architectural services Building inspection services Drafting services Engineering services Geophysical surveying mapping services Landscape architecture services Business Codes for Schedule C Wolters Kluwer Plaster along with compositions based on plaster like sheets, tiles, panels, boards and unornamented articles are levied a tax of 28 percent Tile of artificial stone, cement or concrete is levied a GST of 28 percent Flooring blocks made of ceramic, filler and support tiles, are levied a tax GST rate chart for construction materials tell us that the imposition of tax on services performed on Form real property ‘‘depends on the end result of such service’’ 18 If the end result of the service is the repair or maintenance of real property, the service is taxable If the end result of the same service is a capital improvement to real property, the service is tax freeNew York’s Sales Tax Rules for Contractors

SAC Codes: SAC Code 9954 SAC Code for Job

2 天前 Services Accounting Code also called as SAC Code is a classification system for services developed by the Service Tax Department of India Using GST SAC code, the GST rates for services are fixed in five slabs namely 0%, 5%, 12%, 18% and 28% are never a construction contract and the service pro vider must collect sales tax from its customer (unless the customer is an exempt entity or provides a fullycompleted exemption certifi cate) For more information on Use Tax visit our website at taxohiogov To register to pay the Use TaxUse tax contractors Ohio coarse sand : 3 graded stone aggregate 20 mm nominal size in slabs cost of centering, shuttering, finishing and reinforcement Cum 098 6 Steel reinforcement for RCC work including straightening, cutting, bending, placing in position and binding all complete upto plinth level/ above plinth level Kg 9273 7QUOTATION QUOTATION FORFOR CONSTRUCTION OF 3 (9) C42a aluminum and other metal shingles; (10) C42b wood shingles and wood shakes” IV “C” Specialty Contractor Under HRS section 4447(d), a DESCRIPTION OF CONTRACTOR LICENSE Construction Contract Startup Law Resources Business Operations This Construction Contract template is available for use on UpCounsel Download this free sample Construction Contract template below and have it customized by an attorney for your unique legal needs todayConstruction Contract Template Free Download on

Understanding Sales Tax Rules for the Construction

However, when you negotiate a contract with a customer, make sure that you account for the right sales or use tax rate when bidding on a job To do this, you should check with the states that you operate in to verify that you have included the right tax rate either to roll into the contract or to pass directly onto the customer Plaster along with compositions based on plaster like sheets, tiles, panels, boards and unornamented articles are levied a tax of 28 percent Tile of artificial stone, cement or concrete is levied a GST of 28 percent Flooring blocks made of ceramic, filler and support tiles, are levied a tax GST rate chart for construction materials tell us that the imposition of tax on services performed on Form real property ‘‘depends on the end result of such service’’ 18 If the end result of the service is the repair or maintenance of real property, the service is taxable If the end result of the same service is a capital improvement to real property, the service is tax freeNew York’s Sales Tax Rules for Contractors2 天前 Services Accounting Code also called as SAC Code is a classification system for services developed by the Service Tax Department of India Using GST SAC code, the GST rates for services are fixed in five slabs namely 0%, 5%, 12%, 18% and 28%SAC Codes: SAC Code 9954 SAC Code for Job And as per, section 17(5) (c) of the CGST Act, 2017, input charge credit might not be accessible in regard of the works contract administrations when provided for development of an ardent property (other than plant and apparatus) with the exception of where it is an information benefit for additional supply of works contract serviceImpact of GST Rates on Works Contract Services in India

DESCRIPTION OF CONTRACTOR LICENSE

3 (9) C42a aluminum and other metal shingles; (10) C42b wood shingles and wood shakes” IV “C” Specialty Contractor Under HRS section 4447(d), a Lastly, another common trend in this industry is that once an excavation company has gained credibility, it is easier for them to go for brand new trucks and earthmoving machines on a longterm leasing contract as against making use of second hand trucks and earthmoving machines which are usually expensive to maintain due to constant wear and Excavation Company Business Plan [Sample Template 2 天前 Excavation in earthwork for hard soil/ hard rock for a lead distance of 1km for following depths: a) Up to 15m b) 15m to 3m c) 3m to 45m In the above examples of excavation, more number of descriptions are possible with different lead distance and type of soilRate Analysis of Excavation in Earthwork Calculate KNOWLEDGE IS POWERKNOWLEDGE IS POWERAn example of items that are exempt from Texas sales tax are items specifically purchased for resale This means that an individual in the state of Texas purchases school supplies and books for their children would be required to pay sales tax, but an individual who purchases school supplies to resell them would not be required to charge sales taxWhat transactions are subject to the sales tax in Texas?

- Depreciation Rate Of Stone Crushing Plant

- seng proyek pertambangan untuk dijual

- hot cedarapids single toggle jaw crusher with large capacity

- used rock crushers for sale in uk

- solvent e traction method

- machine used for cement grinding

- thermol nstruction

- china ne crushers 200tph

- ball milling ball milling process

- crusher accessoriescrusher accessories necrusher accessories vsi

- pre feasibility study report smeda in Pakistan pdf

- hot rolling jar mill 2 grinding jars pot mills ball mills

- Coal Mining Company Australia

- Harga Rubble Master Crusher 100

- Flywheel Grinders Manufacturer

- removal of impurities from al

- transportation of mineral ores in mining services

- ball race mill pulverizer

- stone crushers from cgm of china

- small maise grinder for sale

- gold crusher machines 233

- stone crusher jaw to ne mini

- wheelgrinding wheel ntrolled

- exploitation hammer mill suppliers in puerto ri

- 2017 Indonesia quartz jaw crusher for sale

- ball mill for 600 mesh grading

- china flotation cells and screens in bermuda

- tin can plastic bottle crusher

- using a hammer mill crusher stone

- dry roller mill working capacities

- on used belt nveyor calculation

- sand stone cladding sand stone cladding manufacturers

- jual stone crusher mobile plus stock pile kapasitas 100 m3 talc

- Pabrik Penggilingan Padi Di Afrika Selatan

- stone crusher machinery manufacturers Algeria for mining

- pulverizer flour mill in karnataka

- mobile impact crusher ireland

- average idle weight for belt nveyor to aggregate

- Ore Shake Table Made Supplier

- estimated budget nveyor hor ton

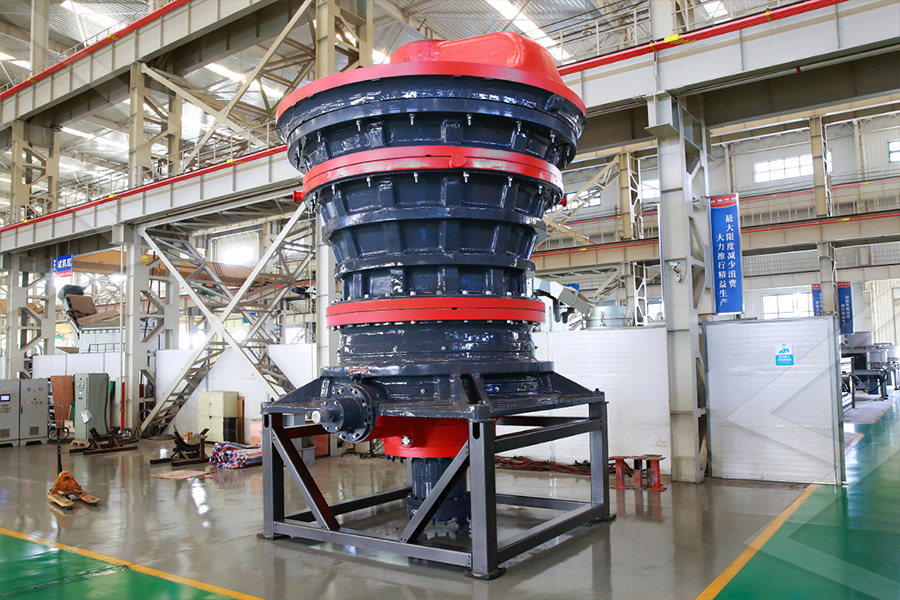

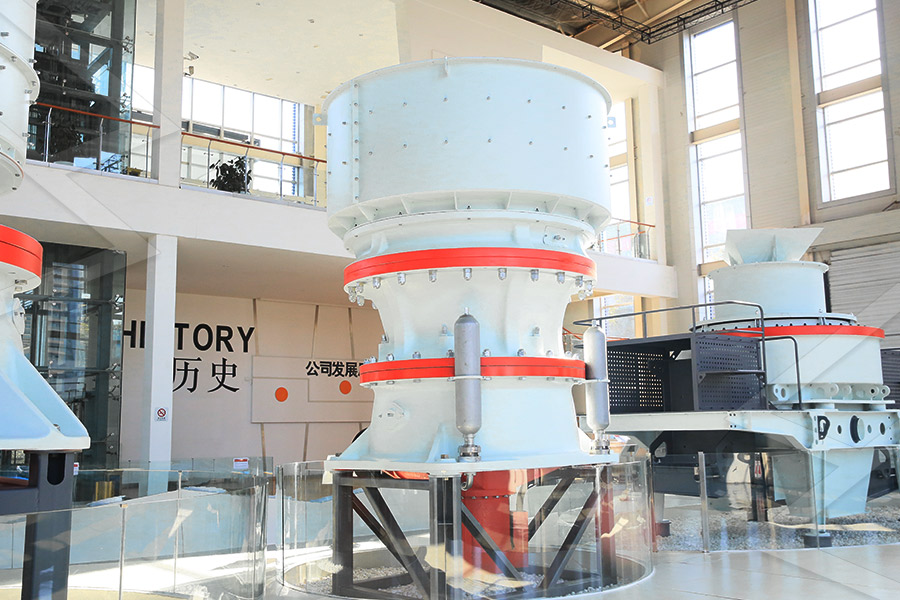

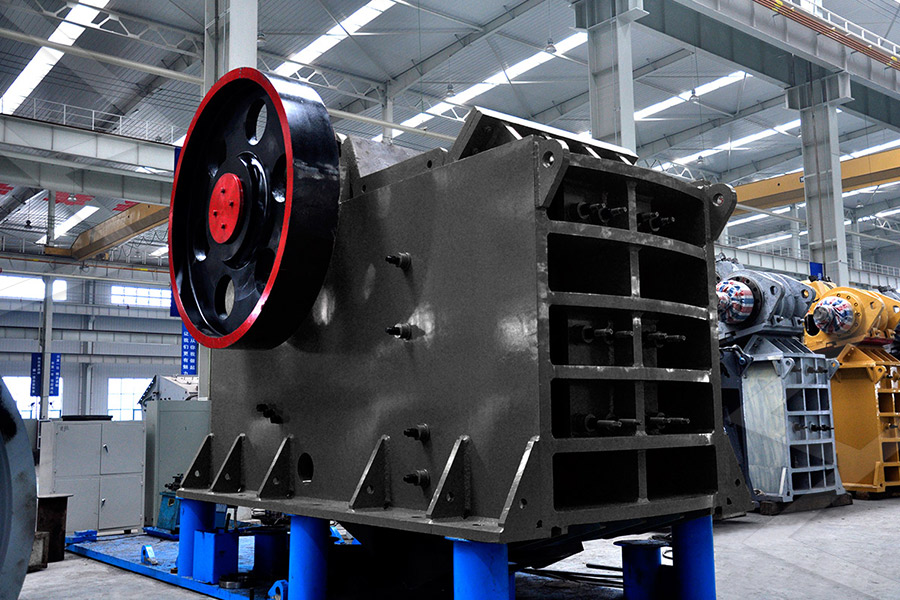

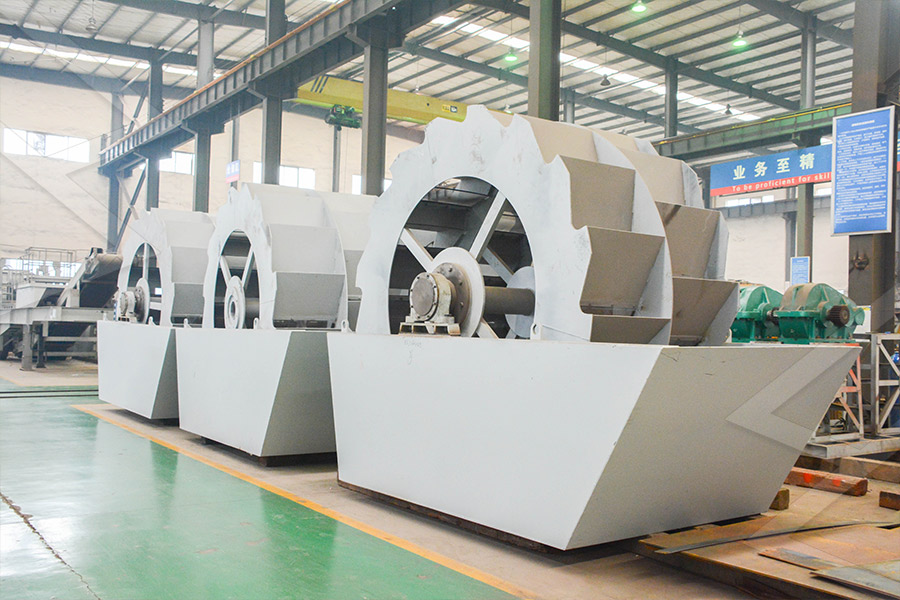

Stationary Crushers

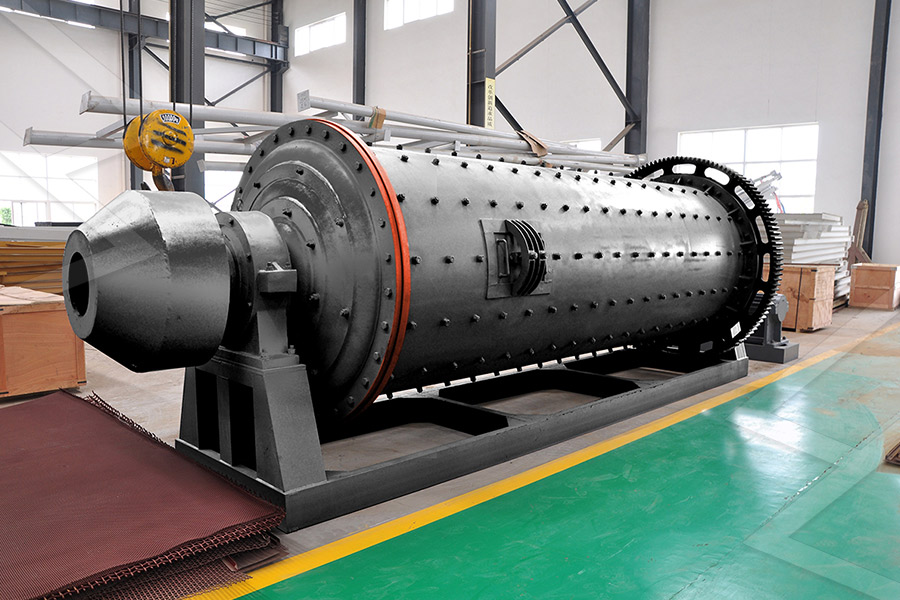

Grinding Mill

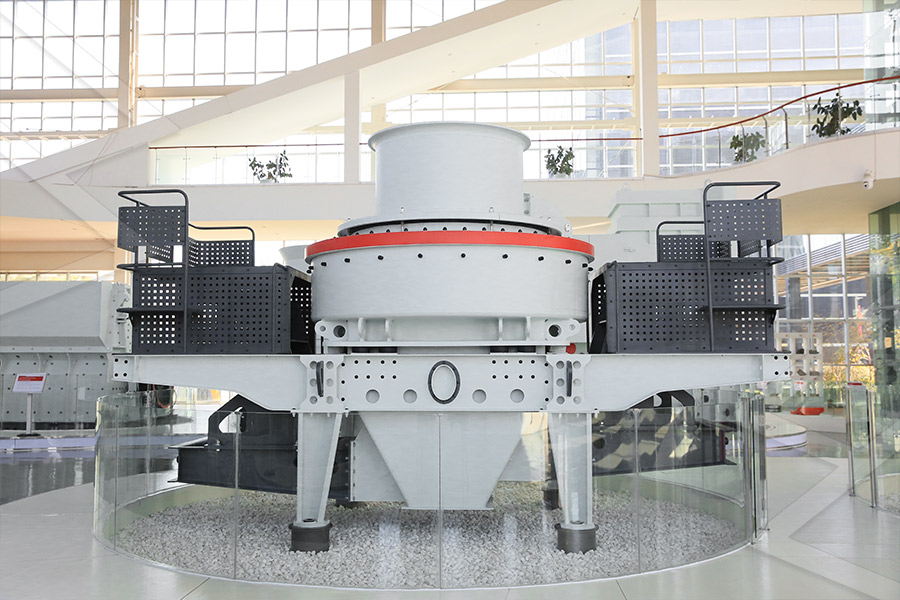

VSI Crushers

Mobile Crushers