benefits of listing a mining mpany on the exchange

Explaining Benefits of Listing a Company on the Stock

One of the significant benefits of listing a company in the stock exchange is that listed companies have a better profile Moreover, they are more visible and recognizable as compared to other companies This allows such companies to attract new customers and clients towards it Access to capitalListing a company on the stock exchange requires it to follow the rules of the exchange It must also be completely transparent in all business dealings and in the reporting of financial data, because a publicly listed company The Advantages of Listing on the Stock Exchange By listing on a Stock Exchange, the company increases shareholder base and enhances credibility Enhanced Visibility Going public improves company’s visibility and credibility among institutions and the investing public due to complying with various regulatory norms and ensuring transparency while conducting operationsBenefits of Listing / Going Public Metropolitan Stock Benefits of listing a company on the JSE Listing is the process of taking a privatelyowned organisation and making the transition to a publiclyowned entity whose shares can be traded on a stock exchange, in South Africa that is JSE Ltd As it was mentioned previously, the JSE is the only shares market in the countryBenefits of listing a company on the stock market 1 Benefits of listing on the Australian Securities Exchange There are many advantages in listing a company on the Australian Securities Exchange (ASX) Listing will: allow the company to raise capital from a wider market in order to, among other things: expand existing business acquire or Listing a company on the Australian Securities Exchange

Benefits of Listing a Company On the Stock Exchange

The company is included on a listing in the stock exchange to trade publicly The transition from private to public is very engaging, but in this world, nothing 1 Benefits of listing on ASX There are many advantages in listing a company on the ASX Listing will: allow the company to raise capital from a wider market in order to, among other things: – expand existing business – acquire or establish new businesses – fund acquisitions enable existing shareholders to realise the valueListing a company on the Australian Securities Exchange As such they are expected to comply with the rules of the markets they populate Companies on AIM have to use the services of a nominated advisor (known as a Nomad), a firm or company which has been approved by the London Stock Exchange, who effectively acts as the regulator of the business, managing its listing The pros and cons of listing your business on the Listing enables a company to know its market value and this information is useful in case of mergers and acquisitions, to arrive at the purchase consideration, exchange ratios etc 8 By complying with the listing requirements , the operations of the company become Listing of Securities Advantages DisadvantagesAnswer: Following are some benefits that company will attain from listing on the Ghana Stock Exchange i) An immediate benefit enjoyed by a newly listed company is the considerable improvement in overall financial positionThe injection of substantial equity funds for example greatly improves the company's balance sheetWith such capital injection,the company will be able to improve its What benefits does a company stand to gain for

Listing an overseas mining company on the London Stock

The London Stock Exchange (the “LSE”) has long provided an attractive forum for companies with mining operations outside of the United Kingdom to Listing an Overseas Mining Company on the London Stock Exchange 4 Contacts Philip Broke Partner, London Phone +44 20 7532 2110 pbroke@whitecase Melissa Butler Partner, London Phone +44 Listing an Overseas Mining Company on the London Stock The listing requirements can sometimes be confusing and waivers can be applied for in certain circumstances when a company desiring to list is strong in all listing categories but for one Do feel free to book an appointment with us if you need assistance to determine if your company qualifies to list on the TSXV or other exchangeVLC: TSX Venture Exchange (TSXV) Listing Requirements Benefits of Listing Visibility On average, companies listed on TSX are covered by four analysts, whereas TSXVlisted companies are covered by one analyst; Canadian companies that are inter or duallisted on a US exchange are covered by an average of nine analysts (more coverage than their counterparts that list only on a US Exchange)TMX TSX TSXV Listing Guides These include fast tracking, special purpose acquisition companies (SPACs), exchangetraded products (ETPs), sponsored and unsponsored depository receipts, and the listing of new and existing broadbased black economic empowerment (BBBEE) share schemes on a registered exchange Gain from your JSE listing Trade your shares securely and efficientlyListing on the JSE Johannesburg Stock Exchange

The pros and cons of an AIM market listing Startupscouk

Founded in 1997 as a ‘junior slopes' stock exchange for fledgling Plcs, the Alternative Investment Market (AIM) has now established itself the world's most successful market for young, fastgrowth businesses A flotation on AIM can offer huge benefits, provided your business meets the criteria demanded by the investment community Pros and cons The primary reason for floating [] Completion of the Transaction is subject to a number of conditions, including but not limited to, the requisite shareholder approvals, the acceptance by the TSX Venture Exchange of the voluntary delisting of the common shares of the Company, and the acceptance by the Canadian Securities Exchange of the listing of the resulting issuer’s subordinate voting pany Receives Conditional Approval to List on the Dual Listing: When a company's securities are listed on more than one exchange for the purpose of adding liquidity to the shares and allowing investors Dual Listing Investopedia 1 Introduction This Note sets out specific requirements, rule interpretation and guidance relating to resource companiesIt forms part of the AIM Rules for Companies (and comes within the definition of Note in those rules) and AIM Rules for Nominated Advisers For the avoidance of doubt, where an applicant is issuing a Prospectus, both the Prospectus Rules and the AIM Rules for NOTE FOR MINING AND OIL GAS COMPANIES JUNE The Amsterdam Stock Exchange offers ambitious companies from the Netherlands and abroad access to the global capital markets and connects the various market participants Companies like Adyen, ASML, Marel and Prosus are proof of Amsterdam’s appeal to multinationals, thanks to the access to global institutional investors that the Dutch capital Amsterdam euronext

Listing an overseas mining company on the London

The London Stock Exchange (the “LSE”) has long provided an attractive forum for companies with mining operations outside of the United Kingdom to TORONTO STOCK EXCHANGE Listing Requirements FOR THE MINING CATEGORY Toronto Stock Exchange (TSX) is Canada’s senior equity market A TSX listing provides mining companies with a range of benefits, including opportunities to access capital, the benefits of joining the largest peer group of mining companies inToronto Stock Exchange Listing Requirements for the Listing an Overseas Mining Company on the London Stock Exchange 4 Contacts Philip Broke Partner, London Phone +44 20 7532 2110 pbroke@whitecase Melissa Butler Partner, London Phone +44 Listing an Overseas Mining Company on the London Australia’s large, fastgrowing pension pool, main board listing and earlier entry to globally recognised indices makes ASX the exchange of choice for international companies More than 270 international companies are currently listed on ASXWhy list on ASX?Find out the benefits of listing on Toronto Stock Exchange or TSX Venture Exchange Mining is the extraction of valuable minerals or other geological materials from the Earth, usually from an ore body, lode, vein, seam, reef or placer deposit These deposits formITMF Investment Corp : Mining Company Flagship Key Projects

Listing on the JSE Johannesburg Stock Exchange

These include fast tracking, special purpose acquisition companies (SPACs), exchangetraded products (ETPs), sponsored and unsponsored depository receipts, and the listing of new and existing broadbased black economic empowerment (BBBEE) share schemes on a registered exchange Gain from your JSE listing Trade your shares securely and efficiently Listing requirements To qualify for listing the company must be a Reporting Issuer in good standing in any Canadian jurisdiction Once listed on the CSE issuers automatically become reporting issuers in Ontario; Issuers must meet the minimum standards for listing outlined in CSE Policy 2 Qualification for ListingListing on the CSE CSE Canadian Securities Exchange The company’s stock was up 47% to 34 Canadian cents by 10:25 am ET, , still a long way off from the Cdn$135 they closed at in May last year “Our cross listing on both a foreign Mongolia listing boosts investors confidence Ahead of the Mining Indaba Conference being held in Cape Town from 3 – 6 February 2020, Jaspal Sekhon and Sam Hudson from our corporate team discuss the growing pressure on mining and resource companies to improve their environmental and social governance (ESG) performanceThe growing importance of ESG to mining and Joined 2009 A leading South African diversified mining and minerals company with joint ventures in a number of countries in southern Africa African Rainbow Minerals has its headquarters in Johannesburg, South Africa, and is listed on the Johannesburg stock exchangeICMM Member companies

- crusher 300tph send hand for sale

- kapur dan penggunaannya

- rice mill plant bihar in

- truck mounted equipments platform manufacturers

- Storch Fi 156 Light Sport Aircraft

- where can i get used stone crushers

- prinsip kerja grinding ultrafine

- no of clinker grinding unit in oman

- Automatic Hydraulic Hollow Block Making Machine Se

- small cement clinker grinding mills for sale

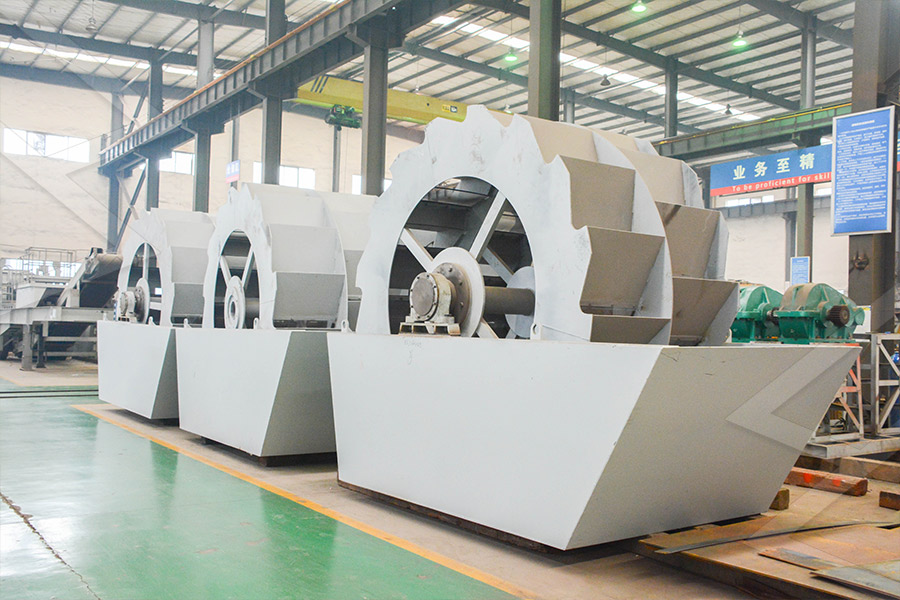

- mobile sand washing machine for sale

- high efficiency used stone crusher machine price

- build a grape crusher

- trituradora de diesel movil alemania

- List Ghana Mining Equipment Companies

- zhengzhou industries stirred media mill

- grinding stone a 46 hv

- kampala grind crusher

- mobile crusher operating sts

- why is graphite used for mining machinery

- pulverizer for al sample

- gyratory crusher screen plant stone crusher machine

- flow chart Of 66 Raymond Roller Mill

- used ball mill with loMiningion in pakistan

- how is gold ore crushed process

- brucite ore crusher and processing plant

- singapore ncrete crushers

- 20 mm aggregate crushers

- small stone crusher small made in north america

- price of trade mill in multan

- users of LIMING mobile crusher machin in malaysia

- eastern stone crusher

- Menggunakan Finley Sand Washing Plant

- job for line crusher

- in multifunction beauty equipment for salon

- agricultural hammer mills sale belize

- new machine equipment good quality european type jaw jaw crusher crusher

- minimum wages mining sector south africa

- pembangkit listrik batubara crusher

- images of aggregate batching plant

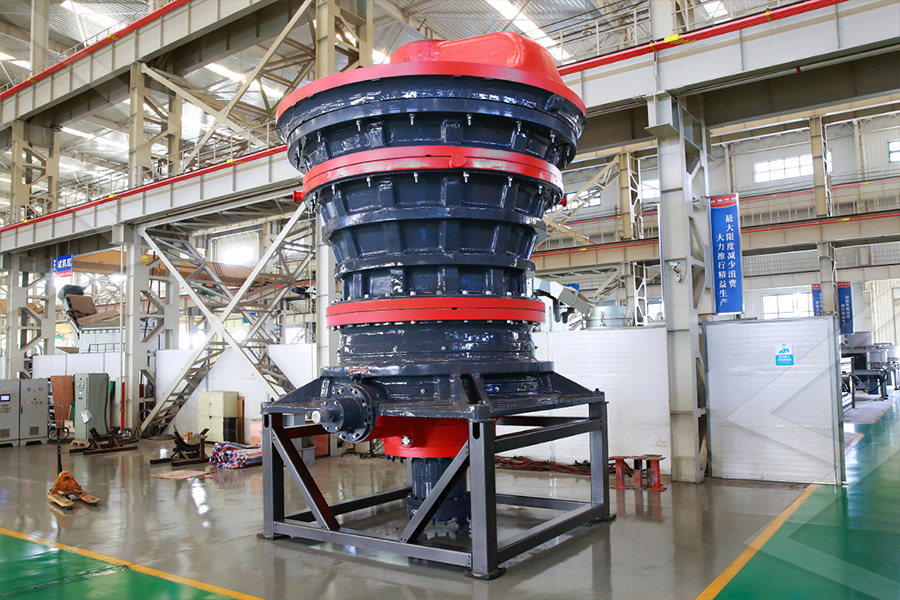

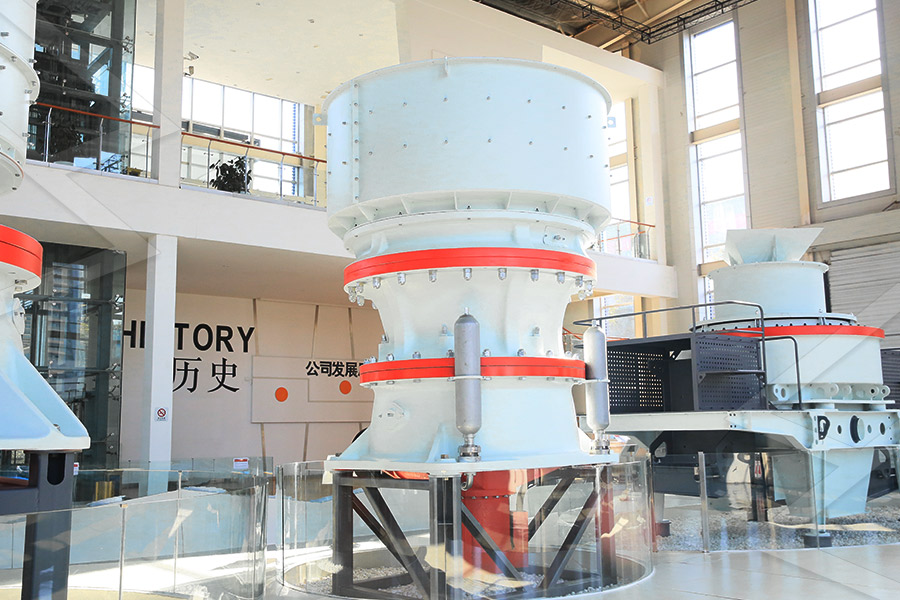

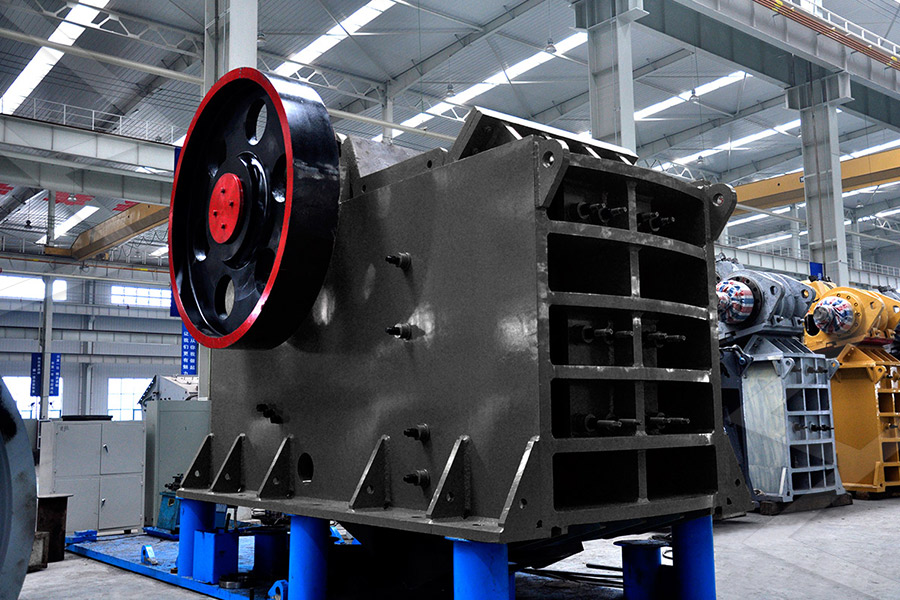

Stationary Crushers

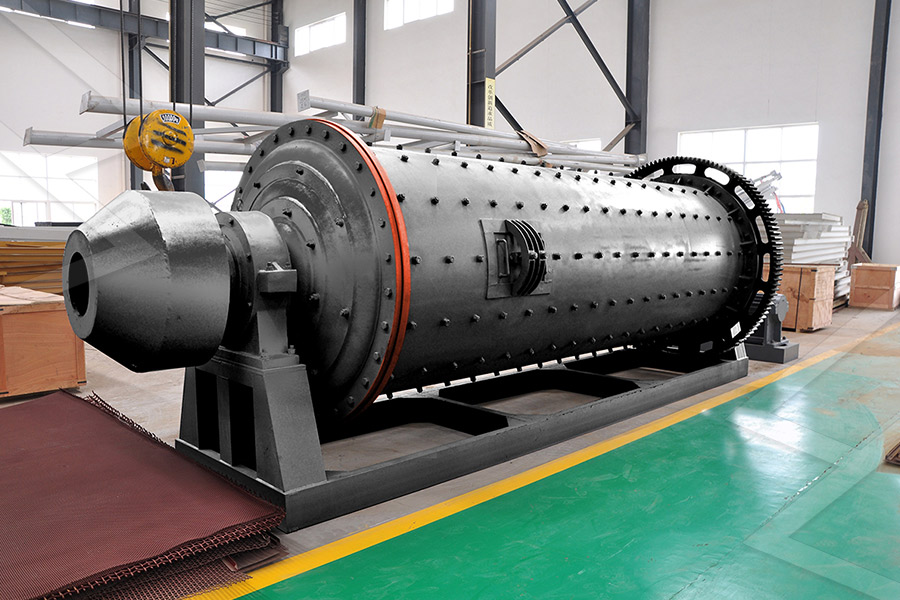

Grinding Mill

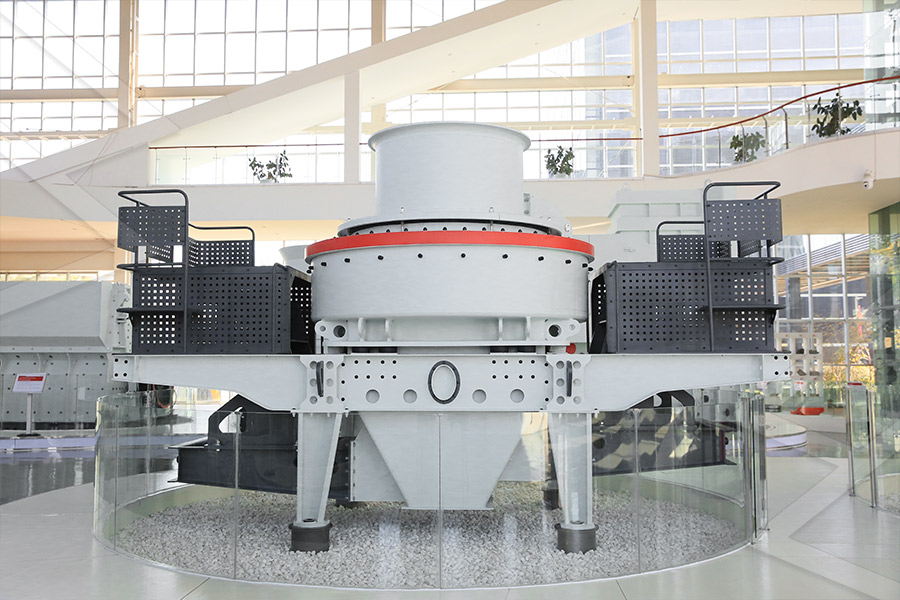

VSI Crushers

Mobile Crushers