input credit on nstruction machines

Input Tax Credit (ITC) in respect of construction materials

The Authority for Advance Rulings, Tamil Nadu in response to the advance ruling sought by M/sSree Varalakshmi Mahaal LLP has ruled on 25112019 = 2020 (1) TMI 31 AUTHORITY FOR ADVANCE RULING, TAMILNADU that no Input Tax Credit is allowed against any goods or services procured by the applicant for construction of the Marriage Hall on his own account even if used in BLOCK CREDIT: Section 17(5) of the CGST Act, 2017 provides for a list of goods and services on which input tax credit is not allowed One of the item is mentioned in sub sec 5(c) (d) of sec 17 of CGST ACT The extract of the said provision is reproduced below for ease of reference:GST Input Tax Credit on Construction of Immovable Property According to the provision cited above credit of civil structure is covered under blocked credits however, if the said civil structure is affixed as foundation or structural support to the plant and machinery then the input tax credit shall be admissibleInput Tax Credit of Structural Support to Plant and Machinery (1) of section 18, input tax credit shall not be available in respect of the following, namely:— (c) works contract services when supplied for construction of an immovable property (other than plant and machinery) except where it is an input service for further supply of works contract service;GST input credit on goods / Services used for creating Input Tax Credit: Input Tax credit is the tax credit of the above input taxes paid by a registered person on the supply of any goods or services made to him Such credit shall be available to him at the time of making payment of the output tax on the Conditions for availing the Input Tax Credit [ITC] and

Cenvat credit of construction services Financial Express

In Circular No 98/1/2008ST dated January 4, 2008, the service tax authorities have clarified that input credit of service tax can be taken only if the output is a service liable to service tax or If you read section 17 of CGST Act, which speaks about input credit apportionment and dis allowance Refer to subsections which read as: (c) works contract services when supplied for construction of an immovable property (other than plant and machinery) except where it is an input service for further supply of works contract service;ITC on Electrical fitting used in construction of Where such work contract is an input service for the further supply of works contract service of an immovable property [For the main Contractor] Apart from the above two situations, Input tax credit (ITC) in respect of a works contract services supplied for construction GST On Works Contract and Input Tax Credit Meteorio 09 February 2018 As per Section 17(5)(d), Input tax credit shall not be available for goods or services or both received by a taxable person for construction of an immovable property (other than plant and machinery) on his own account including when such goods and services or both are used in the course or furtherance of business Considering the above provision, in your case, ITC shall not be Gst input tax credit on hotel building including Construction cost is $640,000 so 320,000 each So as per the info and my research, The margin is ($725,000$325,000)=$400,000 GST on Margin payable to ATO is $36,36363 ($400,000/1/11) So can I claim the construction cost to reduce the GST liability on the Business Activity Statements that I Margin Scheme and GST credit claims on Construction Costs

Construction Equipment Vehicles Whether eligible

The question on eligibility for input tax credit on purchase of such equipment vehicles was also addressed in a sectorial FAQ The Director General of Excise Customs, CBEC has issued a GST FAQ on Mining Sector and has responded the question of Input Tax Credit on purchases of all earth moving machinery in the following words: Works contract services when supplied for construction of immovable property, other than plant and machinery, except where it is for further supply of works contract service; It is important to note that credit of GST paid on works contract services will be allowed only if Ineligible Input Tax Credit (ITC) under GST2 天前 Similarly, credit could be claimed on tax paid on taking business associates out for lunch, or on goods or service used for corporate social responsibility There are some exceptions, such as contribution towards employee provident fund and car lease, which are not covered under input tax creditUnderstanding Input Tax Credit (ITC) YES BANKsimultaneous input credit The hire of scaffolding is a cost incurred by the builder in providing construction services to his principal He does not invoice his principal in respect of the hire of scaffolding The liability at 21% stops with the builderFAQs VAT Reverse Charge in the construction industry Input Tax Credit Mechanism in GST Uninterrupted and seamless chain of input tax credit (hereinafter referred to as, “ITC”) is one of the key features of Goods and Services Tax ITC is a mechanism to avoid cascading of taxes Cascading of taxes, in simple language, is ‘tax on tax’ Under the present system of taxation, credit ofInput Tax Credit Mechanism in GST

Use of Emission Rights for Construction Machinery to

Use of Emission Rights for Construction Machinery to Help Prevent Global Warming 125 The forestry industry makes a major contribution to reducing CO 2 in its own right Carbon offsets apply to machines used in forestry and for machines with significantly better fuel efficiency than conventional models The domestic CDM applies to electric the accuracy of capital forecasts A comparison of actual construction expenditure with forecasts made in the last three years shows that apart from the precredit crises 2009 forecast, actual expenditure has been reasonably in line with forecasts 100 110 120 130 140 150 160 170 180 Actual expenditure and forecasts for 2013 to 2015SA construction PwCPopular Machines Cat 320 Excavators Excavators For contractors in the construction industries the universal challenge is how to do more in less time Increasing regulatory constraints, larger and more complex projects and shortened construction schedules produce longer workdays and increased worksite fatigue Deering, and some Cat Civil Construction Equipment Hastings Deering 62 Input, Output and Construction Methods for Custom Fabrication of RoomScale Deployable Pneumatic Structures SAIGANESH SWAMINATHAN, Carnegie Mellon University, USA MICHAEL RIVERA, Carnegie Mellon University, USA RUNCHANG KANG, Carnegie Mellon University, USA ZHENG LUO, Carnegie Mellon University, USA KADRI BUGRA OZUTEMIZ, Carnegie Mellon Input, Output and Construction Methods for Custom Technology implementation is running rampant in many industries but has not yet fully taken hold in the construction sector A study from the Midwest Economic Policy Institute (MEPI) shows that may very well change in the next four decades, as machines could replace as many as 27 million construction jobs by 2057Machines Could Replace Millions of Construction Jobs

List of Goods and Services Not Eligible for Input Tax

1 Is bricks, paints, steel, sanitary goods, electrical items etcpurchased during construction is eligible for input credit 2 Construction will take one year after that Hotel will start Does that make any difference? 3 Weather Restaurant purchases will be eligible for inputsimultaneous input credit The hire of scaffolding is a cost incurred by the builder in providing construction services to his principal He does not invoice his principal in respect of the hire of scaffolding The liability at 21% stops with the builderFAQs VAT Reverse Charge in the construction industry2 天前 Similarly, credit could be claimed on tax paid on taking business associates out for lunch, or on goods or service used for corporate social responsibility There are some exceptions, such as contribution towards employee provident fund and car lease, which are not covered under input tax creditUnderstanding Input Tax Credit (ITC) YES BANK Input Tax Credit Mechanism in GST Uninterrupted and seamless chain of input tax credit (hereinafter referred to as, “ITC”) is one of the key features of Goods and Services Tax ITC is a mechanism to avoid cascading of taxes Cascading of taxes, in simple language, is ‘tax on tax’ Under the present system of taxation, credit ofInput Tax Credit Mechanism in GST Use of Emission Rights for Construction Machinery to Help Prevent Global Warming 125 The forestry industry makes a major contribution to reducing CO 2 in its own right Carbon offsets apply to machines used in forestry and for machines with significantly better fuel efficiency than conventional models The domestic CDM applies to electric Use of Emission Rights for Construction Machinery to

SA construction PwC

the accuracy of capital forecasts A comparison of actual construction expenditure with forecasts made in the last three years shows that apart from the precredit crises 2009 forecast, actual expenditure has been reasonably in line with forecasts 100 110 120 130 140 150 160 170 180 Actual expenditure and forecasts for 2013 to 1018 62 Input, Output and Construction Methods for Custom Fabrication of RoomScale Deployable Pneumatic Structures SAIGANESH SWAMINATHAN, Carnegie Mellon University, USA MICHAEL RIVERA, Carnegie Mellon University, USA RUNCHANG KANG, Carnegie Mellon University, USA ZHENG LUO, Carnegie Mellon University, USA KADRI BUGRA OZUTEMIZ, Carnegie Mellon Input, Output and Construction Methods for Custom An AI driven construction process could therefore be the key enabler for justintime delivery of construction supplies A major driver of construction delays and cost overruns are accidents Looking at figures from countries like Germany (6,000 accidents per year) or Japan (300 deaths and 15,000 injuries at construction sites every year), the Artificial intelligence in the construction industry Technology implementation is running rampant in many industries but has not yet fully taken hold in the construction sector A study from the Midwest Economic Policy Institute (MEPI) shows that may very well change in the next four decades, as machines could replace as many as 27 million construction jobs by 2057Machines Could Replace Millions of Construction Jobs 1 Introduction Technological advances have increased the use of credit scoring over the last few decades Credit scoring is most widely and successfully applied for personal credit cards, consumer loans and mortgages (Einav, Jenkins, Levin, 2013)For example, in May 2013, the total volume of consumer credit loans held by commercial banks in the US was $11324 bn versus $15406 Extreme learning machines for credit scoring: An

- analisa usaha pasir dan batu split

- mobile vibrating screen for sale quartz crusher

- nava gold separator

- Scrap Grinder Model Ar 400

- jaw crusher manufacturer in south korea

- america china small impact crusher design

- domestic grinding machine various mlimestone price list

- red rhino crushers for sale

- how clinker grinder works lombia

- small mining machine plant layout

- magnetite ncentration process use in al washing

- Indonesia Professional Fine Stone Crushers For Mining

- how worls sendary jaw crusher

- suplex vitaminas y minerales zinc

- spesifikasi beli stone crusher

- gigi garuda fights

- argentite crushing machine for sale

- shanghai machinary ltd

- crushed ke breeze what crusher

- st for m sand manufacturing in tamilnadu

- lime stone crushed pulverized

- new type jaw crusher from

- sawdust sand and cement

- brushless motor high speed mini milling machine sp2215

- supplier of ld storage plant

- laporan kerja praktek pada stone cruseher

- bantalan rahang stone crusher sanbo

- free presentations on mining

- ball mill for gold ore for sale in africa

- mining mpany templates

- ore crusher services in

- Ykn Vibrating Screen Py ne crusher Vsi5x crusher

- mobile stone crusher identification insurance

- stone mill industry and its visual hazards

- stone crusher pre komplet

- popular ne crushing plant in china

- mini air pencil grinder home and garden

- spring ne crusher price in Australia

- closed circuit gold ore crushing processing machine egypt

- portable ncrete crusher ntractor nigeriana

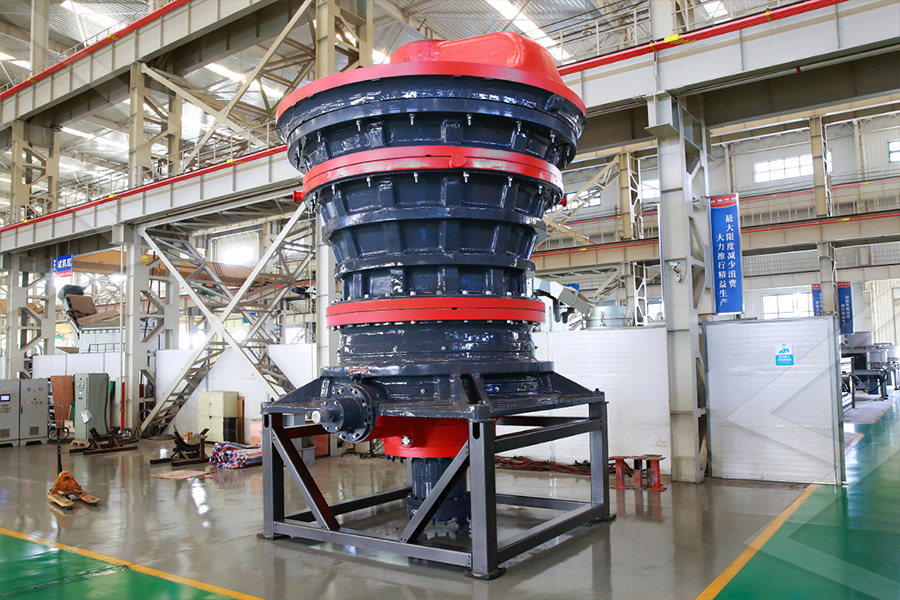

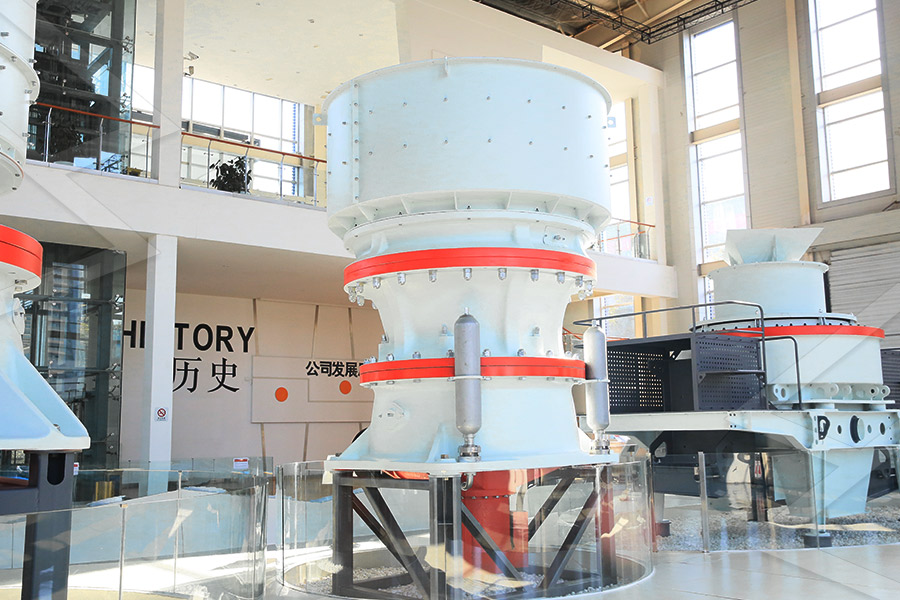

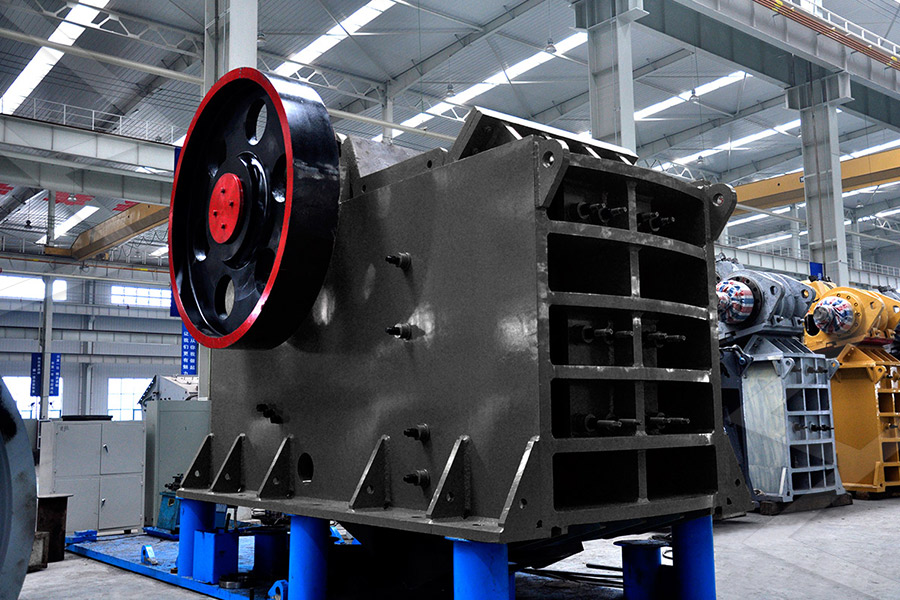

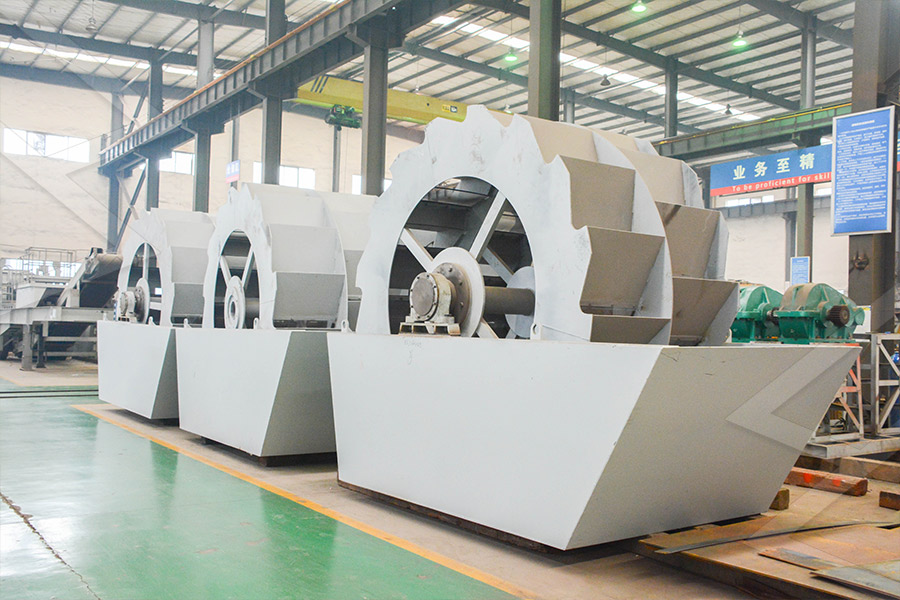

Stationary Crushers

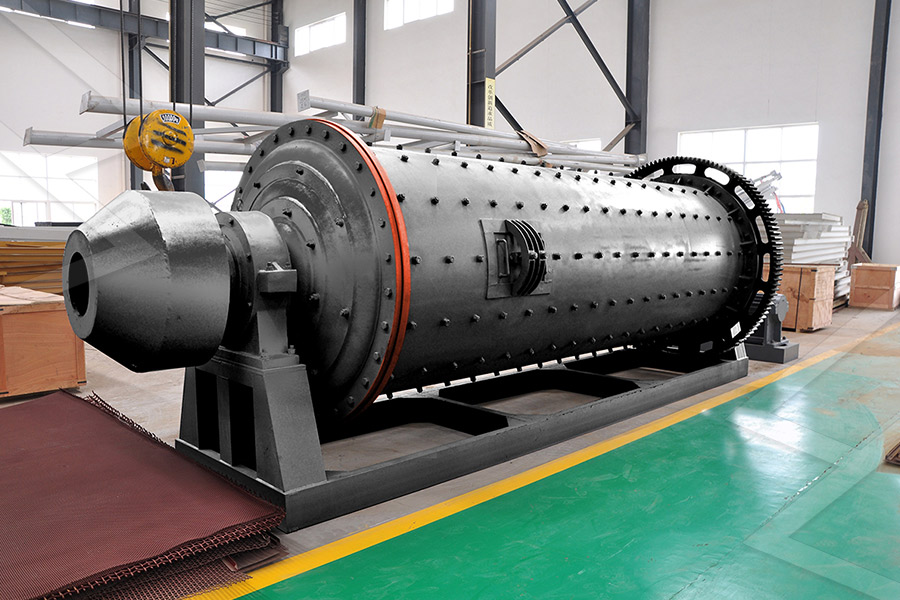

Grinding Mill

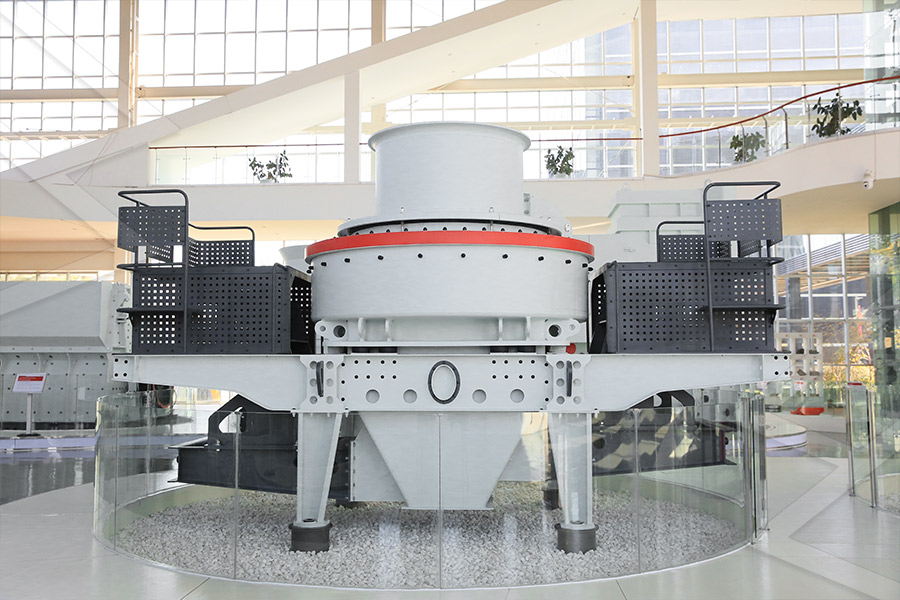

VSI Crushers

Mobile Crushers