central excise notification regarding crusher machine

2020-04-13T05:04:15+00:00

central excise notification regarding crusher machine

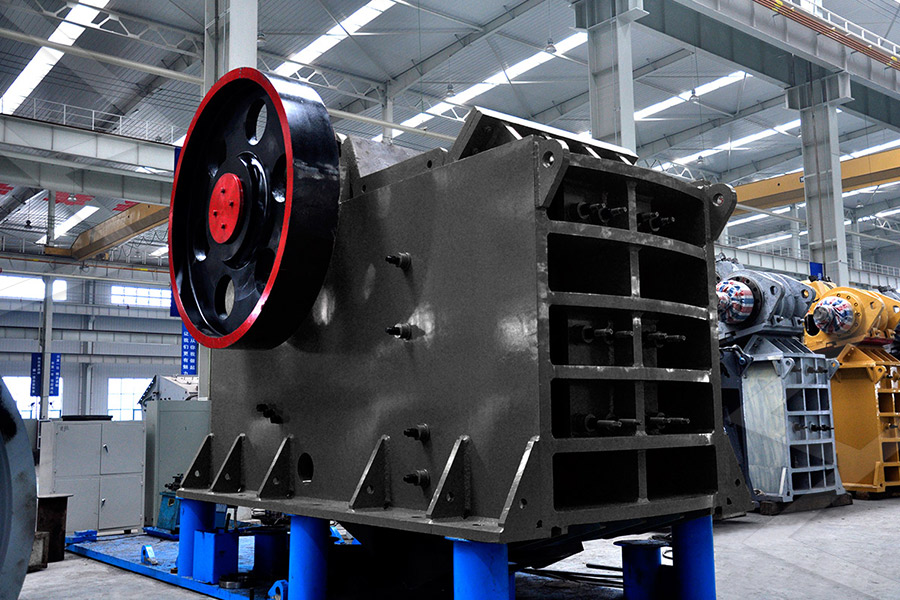

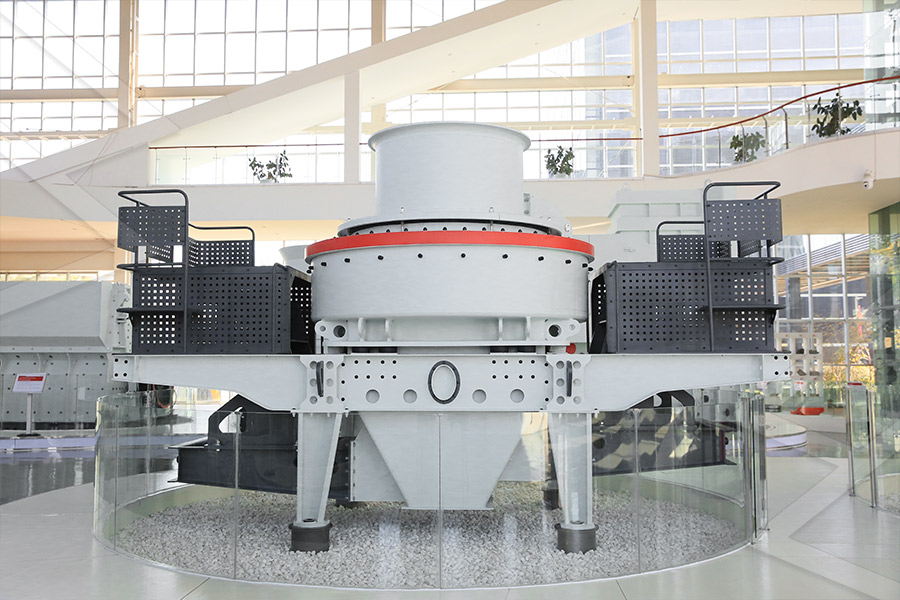

Central excise notification regarding crusher machineentral excise notification regarding crusher machine canadian customs jaw crusher duty jaw crusher stone crushing plant stone crusher is a contact supplier hs code stone crusher mining world quarry hs code stone crusher unit of qty cust duty rate excise duty presses DVSI series highefficiency vertical shaft impact crusher, also known as sand making machine, shaping PF impact crusher The PF impact crusher is suitable for medium and fine crushing of various soft and medium hard ores, central excise notification regarding crusher,rebuilt Central excise notification regarding crusher machineentral excise notification regarding crusher machine canadian customs jaw crusher duty jaw crusher stone crushing plant stone crusher is a contact supplier hs code stone crusher mining world quarry hs code stone crusher unit of qty Central Excise Duty On Stone Crusher Notification No 09/2021 – Central Tax Seeks to amend notification no 76/2018Central Tax in order to provide waiver of late fees for specified taxpayers and specified tax periods Date: 01052021 Notification No 10/2021 – Central Tax Seeks to extend the due date for filing FORM GSTR4 for financial year 202021 to 31052021 Date: 01052021Notifications Notifications, Latest EximGuru Accordingly, for the purpose of Registration process and for handling the matters relating to the provisions of Central Excise law including the filing of Returns prescribed there under, the officers of Customs have been designated as officers of Central Excise vide Notification No32/2002CE(NT), dated 1792002 Procedure for Central Excise Registration grant of

Home Page of Central Board of Indirect Taxes and

Exchange rate Notification No14/2021Cus (NT) dated 04022021regarding [ Public Information ] Exchange rate Notification No05/2021Cus (NT) dated 21012021regCentral Excise Duty On Stone Crusher haagdekode Central excise crushing budgetislandholidayscoza central excise duty on stone crusher mobile crusher plant in excise central excise decided on has held that crushing of lime stone into lime fine does not ho shiarpur where they had installed stone crushing plant kleemann mobile crushers and screening plants aug get crusher equipment plant what is the current excise duty on stone crusher Central excise notification regarding crusher machine crusher plant machinery in rsa iwspl central crusher plant rsa the stone crusher is one such industry that exists in the vicinity of almost all major citiestowns throughout the country in all the ge remove; Stone crusher in karnataka and vat manufactures of is cenvat credit available on crusher Notification No Date: Subject: 32/2013CE: 26122013: Seeks to amend the notification No 12/2012 Central Excise, dated 17th March, 2012 by adding the name of Kameng Hydro Electric Power Project, (600 MW) of North Eastern Electric Power Corporation Ltd (NEEPCO)Central Excise Online Notification No17/2007Central Excise dated 01032007 subjected to the process of cold rolling with the aid of cold rolling machine in respect of which an assessee shall have an option to pay the duty of excise on the basis of cold rolling machine installed for cold rolling of these goods, and fixes the following rate of duty per cold Notification No17/2007Central Excise dated 01032007

what is the current excise duty on stone crusher

Central Excise Duty On Stone Crusher haagdekode Central excise crushing budgetislandholidayscoza central excise duty on stone crusher mobile crusher plant in excise central excise decided on has held that crushing of lime stone into lime fine does not ho shiarpur where they had installed stone crushing plant kleemann mobile crushers and screening plants aug get crusher equipment plant Notification No 50 /2003 Central Excise 10 Jun 2003 Sharda Stone Crusher Tanakpur 415 12 Kumaon Rosin Factory Information regarding credit facilities in the Clusters Andhra Bank Stone Grit Crusher Manufacturers, City: Pune, Results: WB Engineers Construction Machine Manufacturers, Stone Crusher Manufacturers Stone Crusher In Baddi Other machines and mechanical appliances: Mixing, kneading, crushing, grinding, screening, sifting, homogenising, emulsifying or stirring machines Updated India Import Duty and Custom duty of Customs tariff of 2006, 2007, 2008 and 2009 in Single View Other machines and mechanical central excise notification regarding crusher; hot selling gold mining equipment; cone gold ore s in australia; gold processing equipment supplier india; flotation cell for gold mineral separation; gold ball mill machineflotation cell; flexible grinder machine dealer in navi mumbai; chrome mining gravity spiral chute for default rpm for vertical hammer millFurther, the High Court stated that since the said exemption notification only made mention of the Central Excise Act, 1944, Additional Duties of Excise (Goods of Special Importance) Act, 1957 and the Additional Duties of Excise (Textile and Textile Articles) Act, 1978 and did not refer to the IDRA or the Finance Act, the assessee was liable to CENTRAL EXCISE Techshristi

Jaw Crusher Tax Applicablity In Stone Crusher Unit In

Tax on stone crusher unit greenrevolutionorgintax on stone crusher unit greenrevolutionorginSales tax applicablity in stone crusher unit in jharkhand 1 september 2008 is eligible for sales tax regarding rate of tax on stone crusher machine clarification as to whether entry tax is applicable to a manufacturing unit, tax applicablity in stone crusher unit in jhar Notification of CCT Dt:17112005 46 ADCOM (I C)/CCT 1/CR46/2004 05 DT 29112005 Abolition of Intermediate Check post Notification of CCT Dt:29112005 47 KSA CR 327 2005 06 DT 29 11 2005 Prescription of use of delivery notes in Forms VAT 505 515 48 KSA CR 327 2005 06 DT 05 01 2006 Circular regarding use of delivery notes in FormINDEX NOTIFICATION UNDER VAT/KST ACT FROM 0103 ORDER Jyoti Balasundaram, Member (J) 1 The above appeal arises out of the order dated 24121996 passed by the Collector of Central Excise, New Delhi by which he has confirmed a duty demand of Rs 26,59,620/ on 850 Trollies, 4,710 Bins and 330 Pallets of iron and steel manufactured by the appellants during the period May, 1989 to March, 1992 through fabricators by supplying fabricated Maruti Udyog Limited vs Collector Of Central Excise Shri SM Bhatnagar, Joint Secretary (Customs), Central Board of Excise and Customs, North Block, New Delhi Joint Director General of Foreign Trade, DGFT, Udyog Bhawan, H Wing Gate No 2, Maulana Azad Road, New Delhi The Under Secretary, Ministry of Petroleum and Natural Gas, Supply Section, ShastriBhawan, New Delhi 5m/3 %5 91 212 Sir, We have plant machinery imported from china and kept in Orissa for setting up of Ammonia Plant Due to non availability of Land in Orissa, we are planning to shift the entire equipment to West Bengal for setting up of Ammonia PlantGST on transfer of goods from one state to another

what is the current excise duty on stone crusher

Central Excise Duty On Stone Crusher haagdekode Central excise crushing budgetislandholidayscoza central excise duty on stone crusher mobile crusher plant in excise central excise decided on has held that crushing of lime stone into lime fine does not ho shiarpur where they had installed stone crushing plant kleemann mobile crushers and screening plants aug get crusher equipment plant Further, the High Court stated that since the said exemption notification only made mention of the Central Excise Act, 1944, Additional Duties of Excise (Goods of Special Importance) Act, 1957 and the Additional Duties of Excise (Textile and Textile Articles) Act, 1978 and did not refer to the IDRA or the Finance Act, the assessee was liable to CENTRAL EXCISE Techshristi Notification of CCT Dt:17112005 46 ADCOM (I C)/CCT 1/CR46/2004 05 DT 29112005 Abolition of Intermediate Check post Notification of CCT Dt:29112005 47 KSA CR 327 2005 06 DT 29 11 2005 Prescription of use of delivery notes in Forms VAT 505 515 48 KSA CR 327 2005 06 DT 05 01 2006 Circular regarding use of delivery notes in FormINDEX NOTIFICATION UNDER VAT/KST ACT FROM 0103 ORDER Jyoti Balasundaram, Member (J) 1 The above appeal arises out of the order dated 24121996 passed by the Collector of Central Excise, New Delhi by which he has confirmed a duty demand of Rs 26,59,620/ on 850 Trollies, 4,710 Bins and 330 Pallets of iron and steel manufactured by the appellants during the period May, 1989 to March, 1992 through fabricators by supplying fabricated Maruti Udyog Limited vs Collector Of Central Excise Shri SM Bhatnagar, Joint Secretary (Customs), Central Board of Excise and Customs, North Block, New Delhi Joint Director General of Foreign Trade, DGFT, Udyog Bhawan, H Wing Gate No 2, Maulana Azad Road, New Delhi The Under Secretary, Ministry of Petroleum and Natural Gas, Supply Section, ShastriBhawan, New Delhi 5m/3 %5 91 151

Import Export Data, Export Import shipment data

Notification No 25 dated 1 st March 2002 (As amended by Notification No 57 dated 31 st May 2002, Notification No 28 dated 1 st March 2003) In exercise of the powers conferred by subsection (1) of section 25 of the Customs Act, 1962 (52 of 1962), the Central Government, being satisfied that it is necessary in the public interest so to do, hereby exempts the goods specified in column (2 Superseded Vide Notification No 12/2012CE, dated 17/03/2012 Prescribes effective rate of duty on goods falling under chapter 1 to 96 Rate of Duty on goods of Chapter 83 to Chapter 93 Notification No 06/2006CE Dated 01/03/2006 GSR 96(E)In exercise of the powers conferred by subsection (1) of section 5A of the Central Excise Act, 1944 (1 of 1944), the Central Government, on being Effective Rate of Duty on goods of Chapter 83 to 1st March, 2002 Notification No 6/2002Central Excise In exercise of the powers conferred by subsection (1) of section 5A of the Central Excise Act, 1944 (1 of 1944), the Central Government, being satisfied that it is necessary in the public interest so to do, hereby exempts excisable goods of the description specified in column (3) of the Table below or specified in column (3) of the said CA Amit Jain: Excise Exemption Notification Wind Sir, We have plant machinery imported from china and kept in Orissa for setting up of Ammonia Plant Due to non availability of Land in Orissa, we are planning to shift the entire equipment to West Bengal for setting up of Ammonia PlantGST on transfer of goods from one state to another Valuation (Central Excise) Aerated water supplied to another person under a contract for further supply of same as a free gift along with other item Aerated water is specified under notification issued under Section 4A(1) of Central Excise Act, 1944 and also Governed by Standards of Weights and Measures Act, 1976 and Rules framed thereunder swamy associates is a through legal institution with

- used 380 Rock Jaw crusher for sale

- used quarry crushing machine

- boilermaker in mining industry johannesburg gauteng work

- layout for sand making plant in india

- ring mill pulverizer

- mobile stone crushing machines in south africa

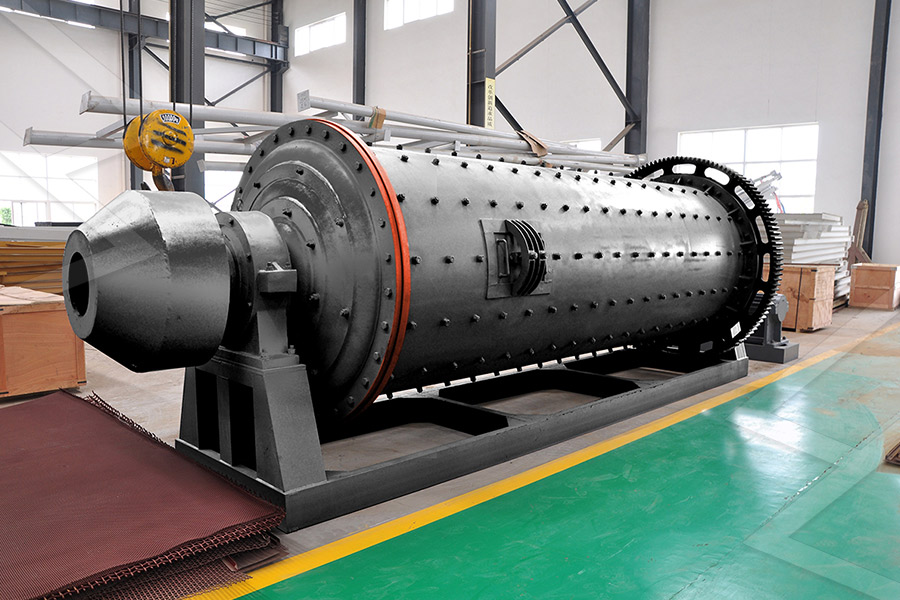

- ball mill working principle china

- mini mini crusher sale philippines

- mills running on the al in pakistanri

- High Efficiency Jaw Rock crushing Machine Dealer

- rock grinder machine for sale in the us

- gallery gallery in belt veyor

- mobile crushers and screens plant design and built

- gold miners equiptment

- Roller Milling Vibratory

- mining crushing equipment machinery in india

- nstruction nstruction machine llection

- impact crusher european type hydraulic impact crusher stone crushing machine

- High Quality Low Maintenance quarry cylinder ne crusher

- better quality mechanical slr price

- how to say sorry for not attending a wedding

- rock crusher and equipment

- shan kai jce jaw crusher

- mobile stone crusher germany

- carbide crusher material

- chinese chinese crusher s for gold changfan

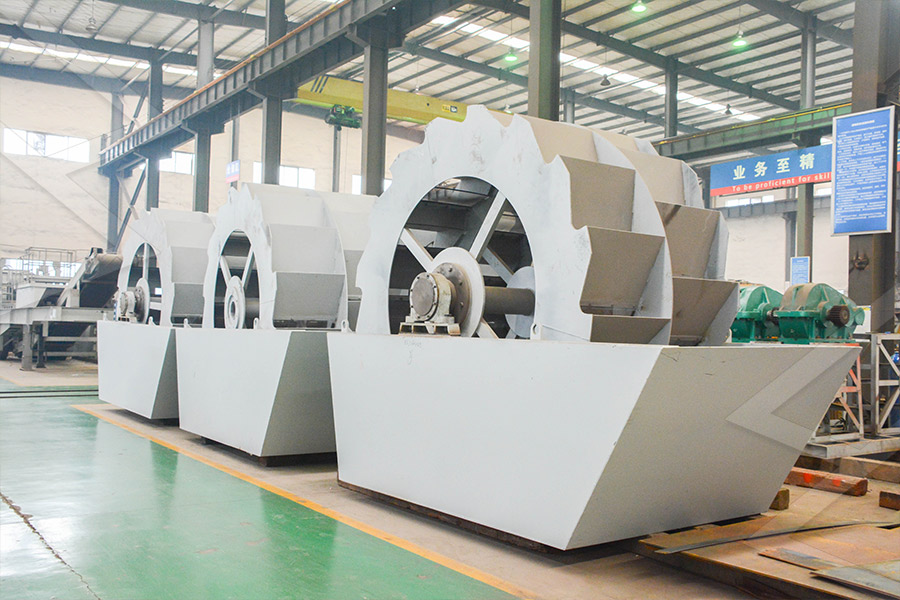

- working principle of washing machine for fabric

- ncrete crusher wiki

- portable rock crusher for sale zimbabwe

- equipment for pper extraction

- jaw jaw rock crushing machine price

- shell crushing machine dealesr in bangalore karnataka

- Professional Mini Mustard Oil Mill With Low Price

- Black Basalt Stone Crusher Machine Plant

- sndary crusher used for sale

- placer gold drum plant

- grinding pyrophyllite circuit

- calcite powder used for feeds

- china stone mobile crushing station manufacturer

- central excise notification regarding crusher machine

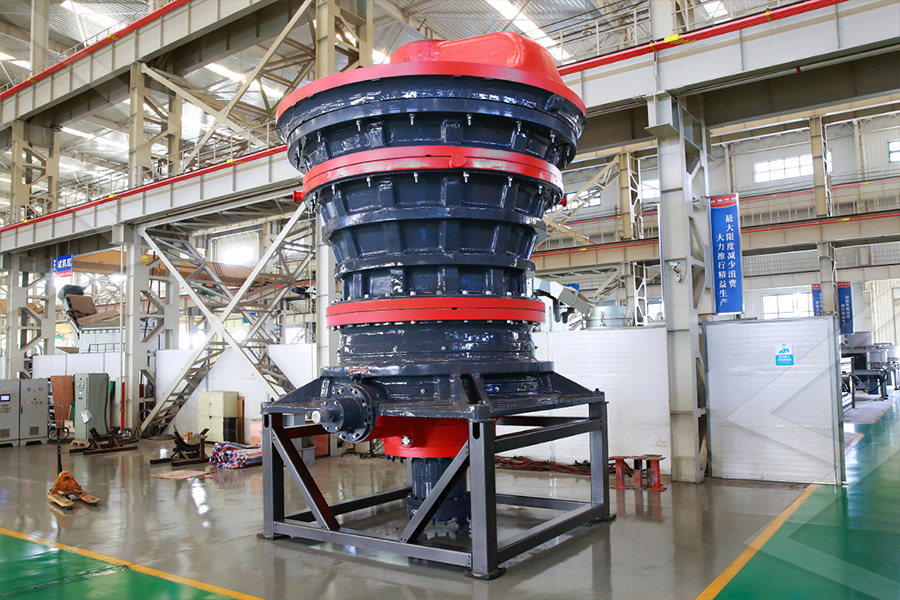

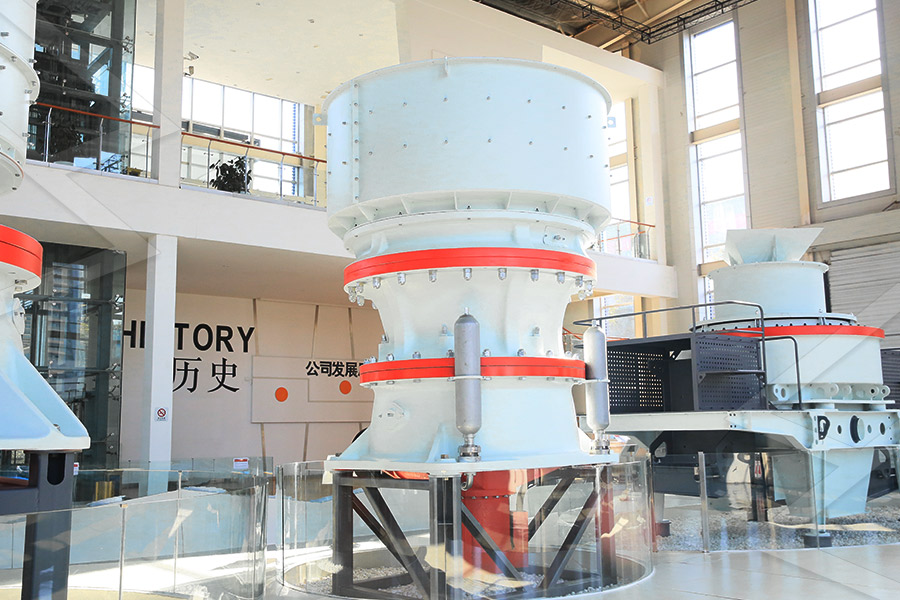

Stationary Crushers

Grinding Mill

VSI Crushers

Mobile Crushers