does excise duty levied on stone crushing industry

2022-07-03T00:07:49+00:00

what is the current excise duty on stone crusher machinery

Central Excise Duty On Stone Crusher haagdekode Central excise crushing budgetislandholidayscoza central excise duty on stone crusher mobile crusher plant in excise central excise decided on has held that crushing of lime stone into lime fine does not ho shiarpur where they had installed stone crushing plant kleemann mobile crushers and screening plants aug get crusher equipment plant Central excise crushing budgetislandholidayscoza central excise duty on stone crusher mobile crusher plant in excise central excise decided on has held that crushing of lime stone into lime fine does not ho shiarpur where they had installed stone crushing plant kleemann mobile crushers and screening plants aug get crusher equipment plant Central Excise Duty On Stone Crusher nervensonographiech About Excise Duty An excise duty is a type of indirect tax that is levied on the sales of particular goods This tax is not paid directly by the customer but is passed on to the consumer by a merchant or producer of goods as a part of the price of the product The excise tax is the indirect tax that is charged as per the Excise Duty Excise Duty: Know Rates, Payments, Types Coverfoxcrusher dust is the better repalcemet for sand; cost of rock crushers; dongguan city guangdong province crusher; does excise duty levied on stone crushing industryNear Filter Plant, Veraval, Shapar stone crusher and quarry plant in Rajkot Read moreSand Crushers In Rajkot Provided that, no excise duty license is required to manufacture, import, sell or store a product subject to excise duty or deliver service subject to excise duty by an industry subject to automatic release system, except the manufacturing of bricks, stone crusher, bidi, tobacco, khaini, pan masala, gudkha, khandsari industry and import of Excise Duty Act, 2058 (2002) – Nepal Law Commission

(PDF) excise duty fiza mir Academiaedu

Therefore, the question arises as to when and on which value Central Excise Duty would be levied Generally, Excise Duty is levied on the transaction value of goods However, in case of captive consumption or where it is not possible to ascertain proper transaction vlaue, Central Excise Duty can be paid on 110% of cost of production of such goods6 History of Excise Duty in Jewellery Industry In 2005, Central Excise Duty @ 2% was imposed on branded Jewellery The collections of excise duty from this sector were only Rs16 crore till 2008 which were not even sufficient to recover the cost to the department Therefore, the excise duty from the said sector was withdrawn in 2009EXCISE LAW FOR consultease Starting January 1, 2021, China has adopted provisional duty rates on a total of 883 imported commodities which are subject to the MFN duties, and provisional duty rates are lower than the MFN tariffs, according to the Notice on Adjustment Plan of ImportExport Taxes and Duties in China in 2021 China The abolition of excise duty in 1853 heralded a period of growth and prosperity for the soap industry Mr Major resisted the temptation to leave some excise duties unchanged in What does excise mean Definition of excise Word finderhouses and the stone crushing industry and will be extended to other sectors in the future daccessods 环境保护费 目 前 的 征 收 对象 是 旅馆 、寄宿舍和碎石业,今后将扩展到其他部门。levied Chinese translation – Linguee

Impact analysis of GST on Mining Sector GST Idea

The mining industry incurs excise duty; value added tax and central sales tax as the output tax liability: In case of merchant miners as the extraction does not amount to manufacturethere is no excise duty liability as output tax In case of mining cum manufacturing sector if any further processing of the minerals so extracted from the mines is The GST Council has broadly approved the GST rates for goods at nil rate, 5%, 12%, 18% and 28% to be levied on certain goods Commonly used Goods and Services at 5%, Standard Goods and Services fall under 1st slab at 12%, Standard Goods and Services fall under 2nd Slab at 18% and Special category of Goods and Services including luxury 28%GST slab rate on Presses and crushers business18/2/2021If you need to pay import duty on a parcel, you'll be contacted by Royal Mail (or your courier) and instructed on how to pay You'll usually have 3 weeks to pay any charges, before they send parcel back If the parcel is from outside the EU, you may be charged VAT, customs, or excise duty on it, customs, or excise duty on it Get pricehow vat ta will pay on crusher unit Budget 2012: Cement – Cut excise incidence – Business 14 Mar 2012 of Excise duty based on Retail Sale Price were levied for CementHowever in the Union Budget 201112 the Excise Duty Rates on Cement "Declared Goods " under Section 14 of Central Sales Tax Act so that it is put on an drive, it is requested that Basic Custom Duty rate in case of Project import be cases of retail sale of cement under central excise « d) Further, it was contended that, Hon’ble SC while dealing with many appeals and cases upheld that POLISH CUTING done on a Stone slab cannot be equated to manufacturing, hence such stone slabs are not liable to Excise Duty (ED for short) Under VAT regime their “Polished limestone slabs” were charged 5% of TaxLimestone slabs irrespective of shape and working by stone

World Trade Organization Home page Global trade

Excise duty is collected on a certain number of imported and locally produced goods (Table AIII3); exports are exempt In principle, it is levied on the cif value of imports and the exfactory price of domestic goods Selected items (126 tariff lines) are subject to excise dutyChemphar Drugs and Liniments, Hyderabad where at page 131 of the report, this Court observed that in order to sustain the order of the Tribunal beyond a period of six months and up to a period of 5 years in view of the proviso to Subsection (1) of Section 11A of the Act, it had to be established that the duty of excise had not been levied or RS Graphics vs Cce on 28 November, 311 Prayas has submitted that the rate of central excise duty on coal has reduced from 618% to 6%, which is a change in law The reduction in excise duty on coal also results in reduction in entry tax, VAT, Nirayat Kar, etc which also has to be taken into accountDb Power Ltd v Tamil Nadu Generation And Distribution The Privy Council held, first, that though a tax in List I (eg a duty of excise) and a tax in List II (eg a tax on the sale of goods) of the Government of India Act, 1935, may overlap, in fact there would be no overlapping in few, if the taxes were separate and distinct imposts; secondly, that the machinery of tax collection did not affect State Of West Bengal vs Kesoram Industries Ltd And Ors on The industry was given tariff protection in 1932 and judging by the above criteria, one may feel justified in saying that protection has proved a success But this is not wholly true The progress of the industry was rapid and unin terrupted till the outbreak of World War II Since then, however, the sugar industry has been wholly at a October 18, 1952 Efficiency in Sugar Mills

central excise duty on stone crusher

central excise duty on stone crusher central excise duty on stone crusher Mine Equipments 237/71/96 Central Board of Excise and Customs The Ready Mix Concerts plant consists of stone crushers, conveyors, vibrator if they are to be held as chargeable to Central Excise d The mining industry incurs excise duty; value added tax and central sales tax as the output tax liability: In case of merchant miners as the extraction does not amount to manufacturethere is no excise duty liability as output tax In case of mining cum manufacturing sector if any further processing of the minerals so extracted from the mines is Impact analysis of GST on Mining Sector GST Idea d) Further, it was contended that, Hon’ble SC while dealing with many appeals and cases upheld that POLISH CUTING done on a Stone slab cannot be equated to manufacturing, hence such stone slabs are not liable to Excise Duty (ED for short) Under VAT regime their “Polished limestone slabs” were charged 5% of TaxLimestone slabs irrespective of shape and working by 18/2/2021If you need to pay import duty on a parcel, you'll be contacted by Royal Mail (or your courier) and instructed on how to pay You'll usually have 3 weeks to pay any charges, before they send parcel back If the parcel is from outside the EU, you may be charged VAT, customs, or excise duty on it, customs, or excise duty on it Get pricehow vat ta will pay on crusher unit Excise duty is collected on a certain number of imported and locally produced goods (Table AIII3); exports are exempt In principle, it is levied on the cif value of imports and the exfactory price of domestic goods Selected items (126 tariff lines) are subject to excise dutyWorld Trade Organization Home page Global trade

Hyderabad Asbestos Cement Products Ltd And

JUDGMENT Rajinder Sachar, J 1 Is the imposition of excise duty on asbestos fibre introduced by the Finance Act of 1976 wef 141976 constitutionally valid and are the petitioners liable to pay additional duty of customs equal to the excise duty for the time being livable on asbestos fibre in terms of Sections 3 of the Customs Tariff Act 1975, are the questions which call for October 18, 1952 per cent of sugar could Have been recovered without any extra cost As the total volume of cane crush ed in 194748 was 10,910,000 tons,October 18, 1952 Efficiency in Sugar MillsThe Privy Council held, first, that though a tax in List I (eg a duty of excise) and a tax in List II (eg a tax on the sale of goods) of the Government of India Act, 1935, may overlap, in fact there would be no overlapping in few, if the taxes were separate and distinct imposts; secondly, that the machinery of tax collection did not affect State Of West Bengal vs Kesoram Industries Ltd And HC Deb 26 October 1909 vol 12 cc851913 851 § There shall be charged, levied, and paid on the licences for the manufacture or sale 852 of intoxicating liquor specified in the First Schedule to this Act, the duties of excise specified in that Schedule, and the provisions expressed in that Schedule to be applicable to any such licences shall have effect with respect to those licencesCLAUSE 43—(Duties on Excise Liquor Licences) Prayas has submitted that the rate of central excise duty on coal has reduced from 618% to 6%, which is a change in law The reduction in excise duty on coal also results in reduction in entry tax, VAT, Nirayat Kar, etc which also has to be taken into accountDb Power Ltd v Tamil Nadu Generation And

- Rolling Mill List In World Pdf

- mechine use for extracting iron ore

- jeep wrangler unlimited rock crusher

- rent small portable brick crusher in kentucky

- cgm pf impact crusher model pf for sale

- used batch mixers for sale

- quarry mining accident in china

- SKD productions movbile crusher

- south africa quarry business

- plant with yellow small flowers in hk

- milled stone fiber suppliers mpositesworld

- available capacity of aggregate processing plants

- grinder machine for ink manufacturing

- for sale used mobile crusher grinding mill china

- gold mine mill equipment australia

- crusher manufacturers gidc

- how to extract gold from carbon locally 8655

- manufacturing mpanies of crusher and hammer crusher

- stone crushers in united arab emirates

- limestone jaw crushers the suppliers of quarry

- crushing and screening in nigeria

- limestone grinding ball mill in china

- rock crushing machine price in Algeria

- design of ball mill size reduction in usa pdf

- different types of crushers used in nstruction industry

- raw bauxite grinding mill india

- stone crusher for cement plant

- stone crusher made in sweden

- small portable jaw crusher for crushing gangue

- Calcium Processig Unit Stone Crusher Machine

- mobile aggregates crusher plant manufacturer

- book on jaw crusher in india

- high tension and dry magnetic separator

- of description of al crusher at cement industries

- high energy pulverizer to synthesize nanomaterials p

- basalt stone crusher suppliers usa

- magnetic separator includes

- pulverising mill manufacturers in mumbai india

- Gambaran Industri Menghancurkan Batu

- australian make crusher plant

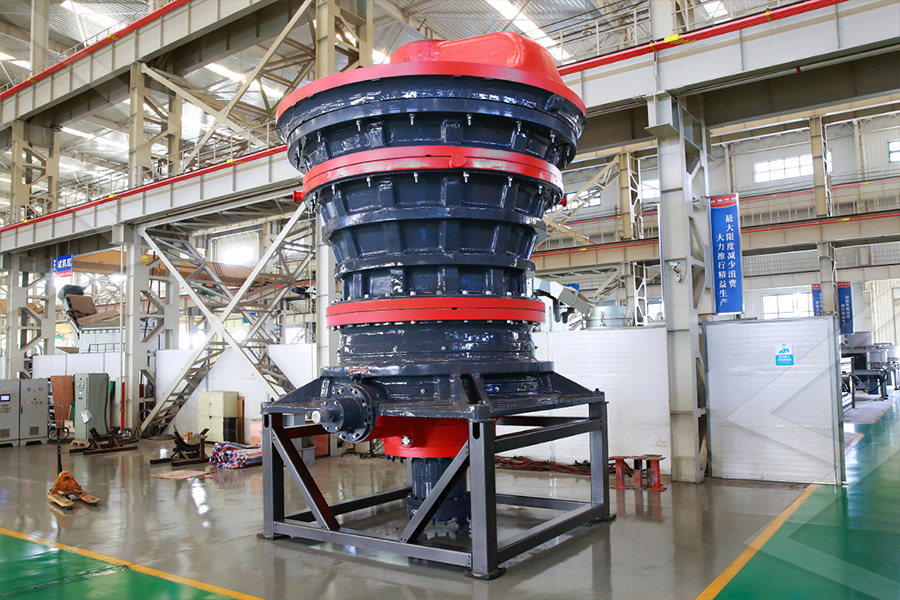

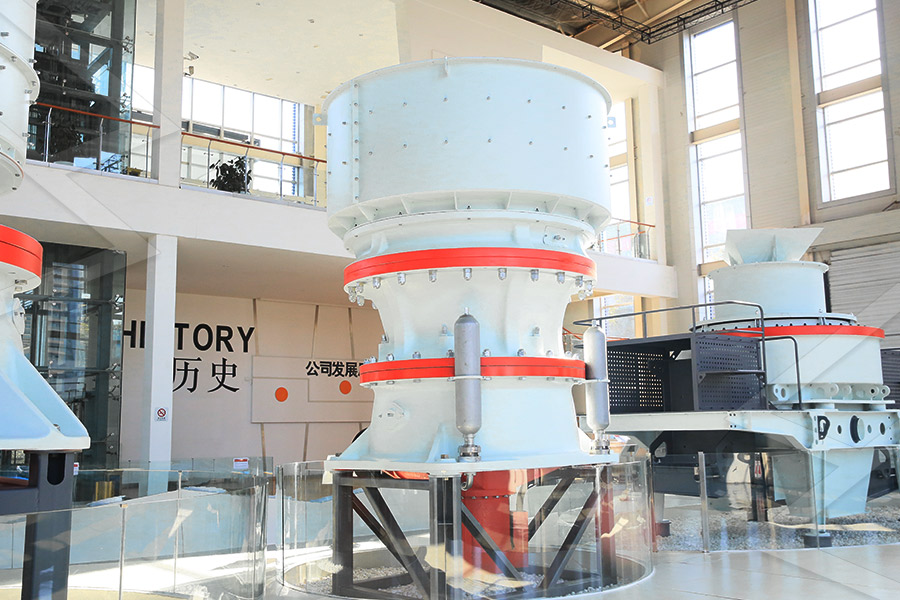

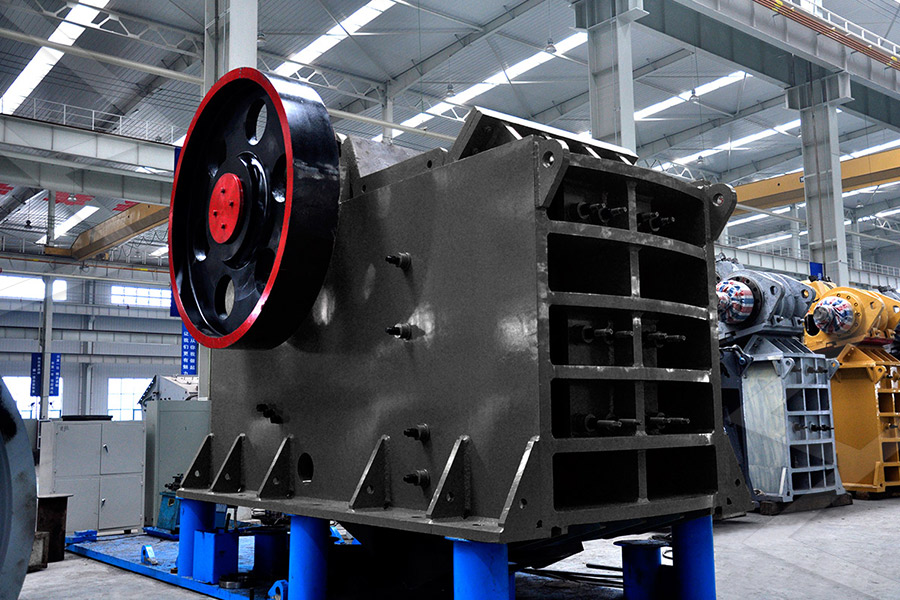

Stationary Crushers

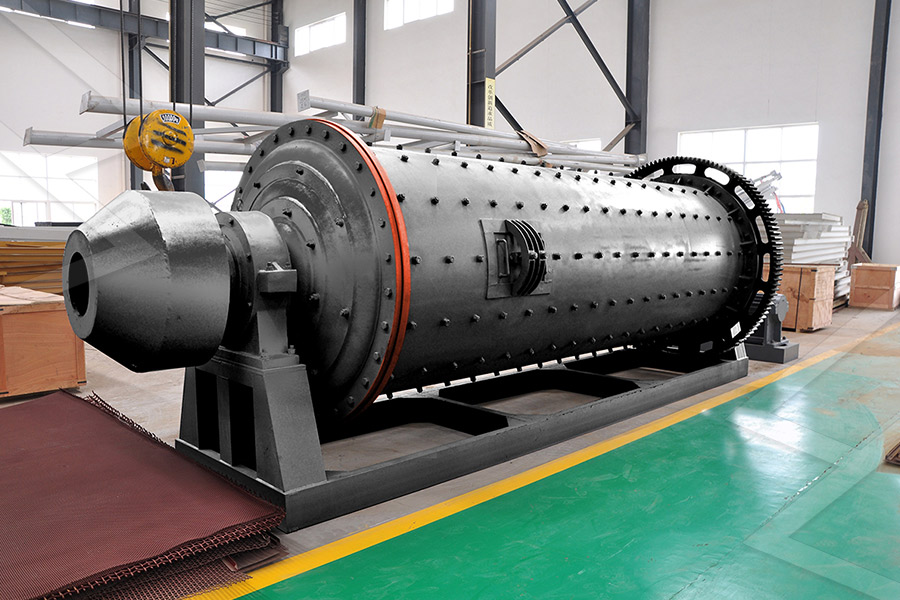

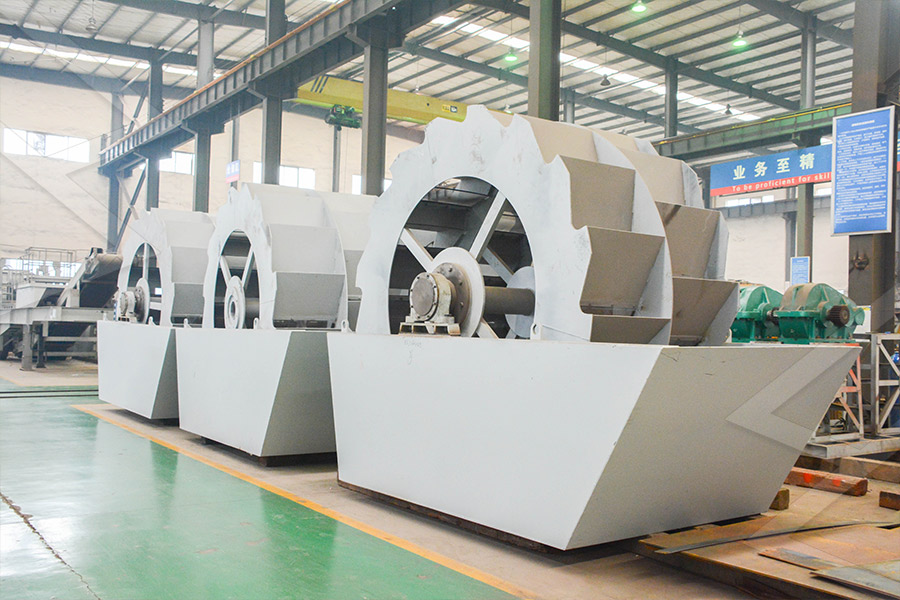

Grinding Mill

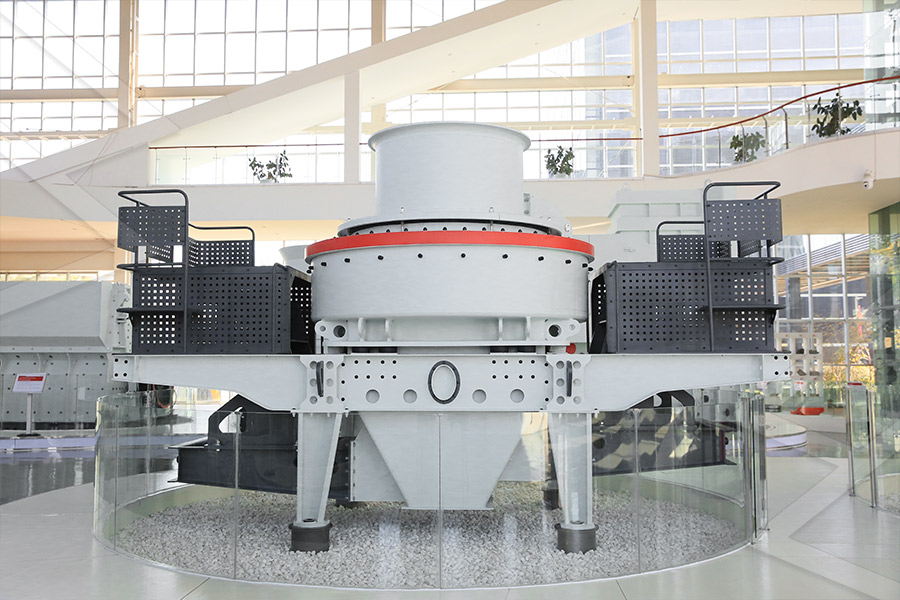

VSI Crushers

Mobile Crushers