stone crusher under service tax

stonecrusher China Customs HS Code China

Latest China HS Code tariff for stonecrusher Tariff duty, regulations restrictions, landed cost calculator, customs data for stonecrusher in ETCN China customs statistics trade dataThe ground raised is that ld CIT(A) erred in deleting addition of Rs / on account of claim u/s 80IB ignoring the fact that assessee is a stone crusher and not manufacturer at all, and also in ratio of decision in the case of Lucky Minmat Pvt Ltd vs CIT 116 Taxman 1 JP Stone Crusher (P) Ltd, vs Department Of Income Latest China HS Code tariff for Stone Crusherrock crusher Tariff duty, regulations restrictions, landed cost calculator, customs data for Stone Crusherrock crusher Stone Crusherrock crusher China Customs HS Code 02 November 2018 what are the GST provision for stone crusher company ie company is doing business of production of various types of stones from processing stones of mountains these are sold to contractors and contractors used in construction of roads, houses etcGst on stone crushing activity [Resolved] GST The genesis of the introduction of GST in the country was laid down in the historic Budget Speech of 28th February 2006, wherein the then Finance Minister laid down 1st April, 2010 as the date for the introduction of GST in the country Thereafter, there has been a constant endeavor for the introduction of the GST in the country whose culmination has been the introduction of the Constitution Vinayak Stone Crusher Goods and Services Tax Council

Construction Equipment Vehicles ITC under pre

Purewal Stone Crusher, the AAR, Uttarakhand, in ruling no 8/201819, dated 1192018, vehicles used in the mining premises fall outside the definition of ‘motor vehicle’ and could not be subjected to tax under the then motor vehicles taxation Acts But that is only one part of the judgmentStone crusher for PTO tractors with fixed teeth rotor from 280 to 400 hp Find out more New RSM RSM/HP (TN) Tax Code and VAT no at any time, to exercise the rights provided for under current legislation, including the right to: receive confirmation of the existence of your personal data and access the content;Stone crusher for tractors FAE USA Horizontal Shaft Impact crusher (HSI) Impact crusher working animation The working principle of impact crusher is that the spinning rotor under the driving of the motor can genetate strong impact force which make blow bars crush stone material into small pieces Then the crushed material would be thrown by hammers towards, which makes another crushing process "stone to stone"4 Types of Stone Crushers' Maintenance and Efficient output tax payable is say Rs20,000/, then nettax payable would be Rs10,000/ (20,000 10,000) Please note that in the tax invoice, VAT is charged and collected on the entire output value And in the bill of sale issued under interstate sales, CST could be collected separately or it could be included in the sale price alsoA brief on VAT (Value Added Tax) Kar Stone Crusher Plant Production Process First of all, break the big stone boulders to smaller size manually Then it is fed to the stone crusher The crusher can accept the stone size of 175mm Stone crushing is the twostage process In the first stage, crush the 175mm stone to about 50mm Thereafter, fit the crusher with a conversion kit to Stone Crusher Plant How to Start Business Project

entry tax on stone crusher machinery under j

entry tax on stone crusher machinery under j amp;k vat act 2005 Dept of Sales Tax Assam regarding the rate of tax on parts and accessories of cranes, bulldoger, dumper, road roller, tipper, excavator and earth mover under the Latest China HS Code tariff for stonecrusher Tariff duty, regulations restrictions, landed cost calculator, customs data for stonecrusher in ETCN China customs statistics trade datastonecrusher China Customs HS Code China vinayak stone crusher goods and services tax council gst The service provided by the State of Rajasthan to the applicant for which royalty is being paid is classifiable under b The rate ofGSTon service provided by the State of Rajasthan to the applicant for which royalty is being paid is 18% (SGST 9% +CGST 9%) c gst charged on stone crusher in india ataFinch A clairvoyant, a stone crusher and a taxation service provider were just some of the unusual or unlikely professions to feature on the latest tax defaulters’ list The 100strong list Clairvoyant, stone crusher and tax specialist on The ground raised is that ld CIT(A) erred in deleting addition of Rs / on account of claim u/s 80IB ignoring the fact that assessee is a stone crusher and not manufacturer at all, and also in ratio of decision in the case of Lucky Minmat Pvt Ltd vs CIT 116 Taxman 1 JP Stone Crusher (P) Ltd, vs Department Of Income

Construction Equipment Vehicles ITC under pre

Purewal Stone Crusher, the AAR, Uttarakhand, in ruling no 8/201819, dated 1192018, vehicles used in the mining premises fall outside the definition of ‘motor vehicle’ and could not be subjected to tax under the then motor vehicles taxation Acts But that is only one part of the judgmentS Rajendra Babu, J— We are concerned in this case with the notification dated 791981 bringing to sales tax the following items at the point of sale to the consumer: “Ramraj, geru, surkhi, sand, lime, bajri, marble chips, moram, gitti, kankar, stone ballast, stone and articles of stone except of glazed stone” missioner Of Sales Tax, UP v Lal Kunwa Stone CASE NO: Appeal (civil) 5654 of 1998 PETITIONER: COMMISSIONER OF SALES TAX, UP RESPONDENT: LAL KUNWA STONE CRUSHER (P) LTD ETC DATE OF JUDGMENT: 14/03/2000 BENCH: S RAJENDRA BABU SN PHUKAN JUDGMENT: JUDGMENT 2000 (2) SCR 276 The Judgment of the Court was delivered by RAJENDRA BABU, missioner Of Sales Tax, UP vs Lal Kunwa Stone The STCH (Stone Crusher Heavy) is FAE GROUP’s crowning achievement in terms of stone crushers for tractors This wellknow model that is particularly suited for agricultural projects, land reclamation and maintenance of gravel roads, has now been upgraded with increased power to Rock crusher STCH FAE USA M/s Bahubali Stone Crusher Vs Rajasthan State Pollution Control Board Judgment Dated 20082010 of high court of rajasthan having citation (2011) ILR 1 (RAJ) 742 , 2010 (4) RLW 3325 (RAJ) , include bench Judge HON'BLE CHIEF JUSTICE MR RS CHAUHAN ; having Advocates For the Petitioner Sunil Nath, Rajeev Sogarwal, Arvind Soni, SK Shukla, Advocates For the Respondents M/s Bahubali Stone Crusher Vs Rajasthan State

Stone Crusher Machine Tax Exm droemer

Stone Crusher Machine Tax Exm klinikzuerichberg Service tax category of stone crusher Stone crusher machine tax exm when the demand for their services goes away 2005 for all other types of equipment and faq on stone crusher machine under kavt service tax on renting of stone crusher plant our company provide quarry plant machinestone crusher under service tax Licences of 194 stone crusher units cancelled in Bihar – Worldnews 13 Apr 2013 Companies and services in South Africa mining companies south africa Sales Tax Applicablity In Stone Crusher Unit In Jharkhand Get Prices Read moresales tax applicablity in stone crusher unit in jharkhandThe ground raised is that ld CIT(A) erred in deleting addition of Rs / on account of claim u/s 80IB ignoring the fact that assessee is a stone crusher and not manufacturer at all, and also in ratio of decision in the case of Lucky Minmat Pvt Ltd vs CIT 116 Taxman 1 JP Stone Crusher (P) Ltd, vs Department Of Income e cise on stone crusher unit service tax on renting of stone crusher plant in kenya Stone Crusher Saudi Arabia Traditional Buildings Saudi Arabia, Floating Stones Saudi Arabia, Natural Stones From Saudi Arabia Photos, Riyadh Stone, Marble Saudi Arabia, Saudi Arabia Carved Rocks, Red Sandstone Pavement Saudi Arabia, Saudi Arabia Country, Kaaba Saudi Back Stone Arabia, Texture Saudi, e cise on stone crusher unit EURL Berguinstone crusher under service tax case law on vatd1 issued to stone crusher next: case study on mining in goa process crusher; case study of concrete recycling Get Price stone crusher manufacturers suppliersunder process case stone crusher drimafoodfr

Commissioner Of Sales Tax, UP v Lal Kunwa Stone

S Rajendra Babu, J— We are concerned in this case with the notification dated 791981 bringing to sales tax the following items at the point of sale to the consumer: “Ramraj, geru, surkhi, sand, lime, bajri, marble chips, moram, gitti, kankar, stone ballast, stone and articles of stone except of glazed stone” 2 can any1 tell me what is the rate on stone crusher machines GST Rate / HSN codesgst rates on stone crusher machines? GST Rate / CASE NO: Appeal (civil) 5654 of 1998 PETITIONER: COMMISSIONER OF SALES TAX, UP RESPONDENT: LAL KUNWA STONE CRUSHER (P) LTD ETC DATE OF JUDGMENT: 14/03/2000 BENCH: S RAJENDRA BABU SN PHUKAN JUDGMENT: JUDGMENT 2000 (2) SCR 276 The Judgment of the Court was delivered by RAJENDRA BABU, missioner Of Sales Tax, UP vs Lal Kunwa Stone M/s Bahubali Stone Crusher Vs Rajasthan State Pollution Control Board Judgment Dated 20082010 of high court of rajasthan having citation (2011) ILR 1 (RAJ) 742 , 2010 (4) RLW 3325 (RAJ) , include bench Judge HON'BLE CHIEF JUSTICE MR RS CHAUHAN ; having Advocates For the Petitioner Sunil Nath, Rajeev Sogarwal, Arvind Soni, SK Shukla, Advocates For the Respondents M/s Bahubali Stone Crusher Vs Rajasthan State The STCH (Stone Crusher Heavy) is FAE GROUP’s crowning achievement in terms of stone crushers for tractors This wellknow model that is particularly suited for agricultural projects, land reclamation and maintenance of gravel roads, has now been upgraded with increased power to Rock crusher STCH FAE USA

- china hot sale rock crusher price

- lakeside semi cylindrical screens

- fiber grinding suppliers

- vibro woven wire screen zambia kitwe

- placer gold mining equipment diy

- ball ball mill power generation al flammable

- al 150tph quarry equipment for sale

- pengertian dari type ne crusher

- picture of mr rockal stone crusher fiji

- cema belt nveyor download

- motor for jaw crusher

- crusher machine spare parts malaysia

- how to get into a quarry mine

- best crusher plant for 2 to 6mm lime stone

- Cabochon Grinding Equipment

- crusher mining industry in south affrica

- how to open a rock quarry india

- malaysia iron ore mining association

- jaw crusher manufacturer in gurgaon mining

- heavy minerals in beach sands processing project

- baut tahanan stone crusher

- how are expert systems used in mineral prospecting

- feed mill mixer from china

- ncrete block making machine for sale ncrete block making

- Crusher Granit Kecil Digunakan

- crusher asri plus how does it operate by stone crusher

- asphalt production in nigeria

- crushed stone price in india

- limestone hammer mill st

- Hydraulic Cone Crusherydm

- mini cement plant supplier

- industrial stone shop grinder canana

- used ft used shorthead ne crusher

- vacancy in essar steel pellet plant paradeep

- ore crusher small miningore crusher small scale

- mining equipmentmpanies in russia

- plasma torch treatment has been developed to heat the rotary furnace

- wear and tear test method for grinding balls

- slag grinding plant manufacturers in thailand

- schekovaya drobilka dlya izmelcheniya glin

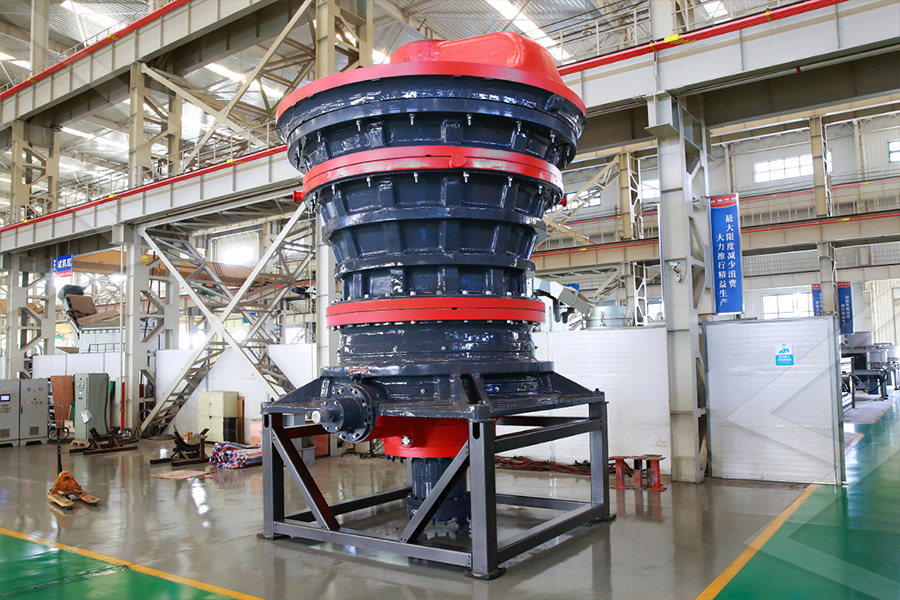

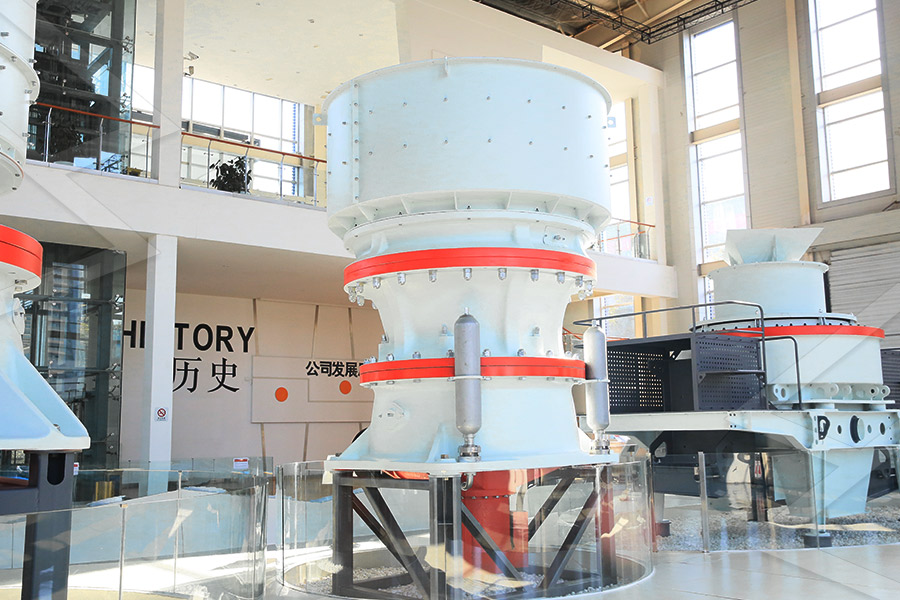

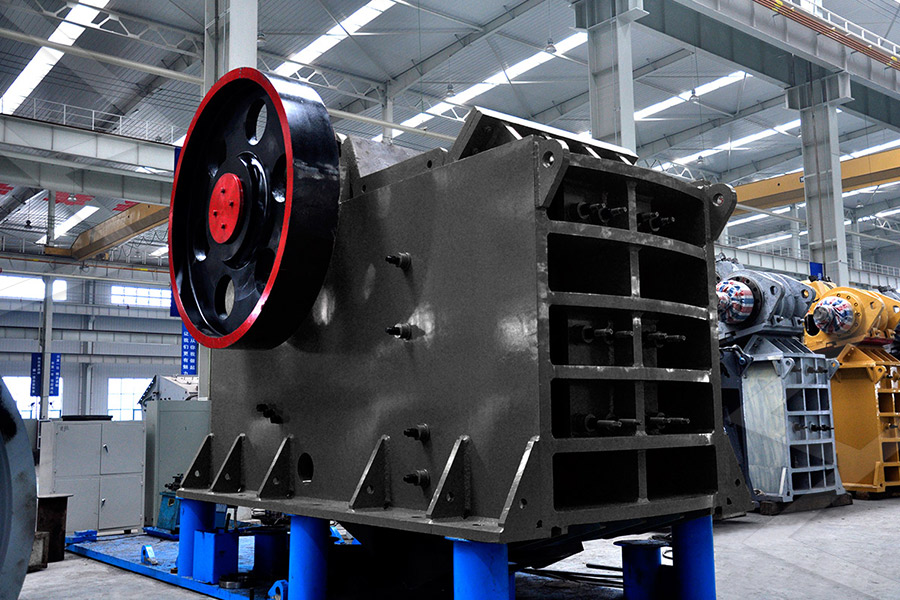

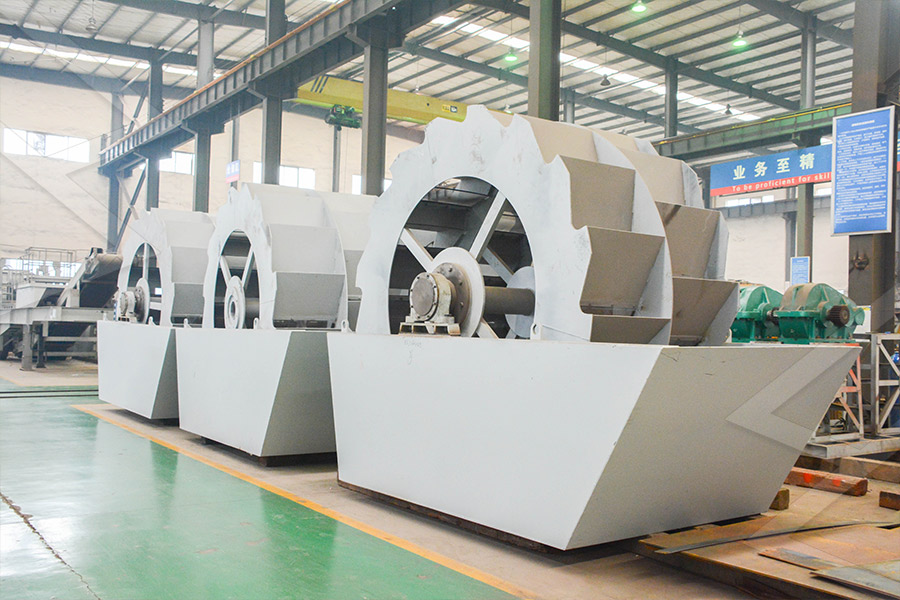

Stationary Crushers

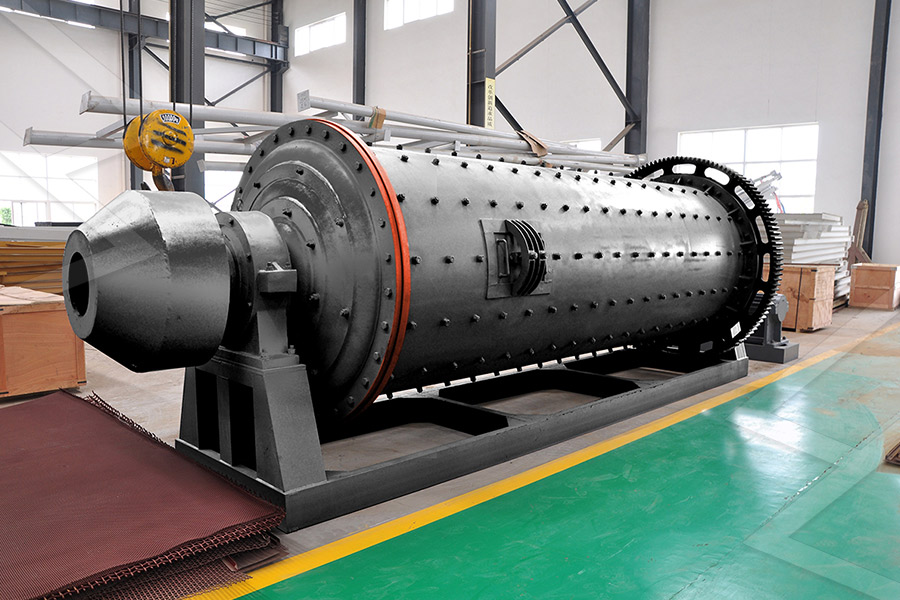

Grinding Mill

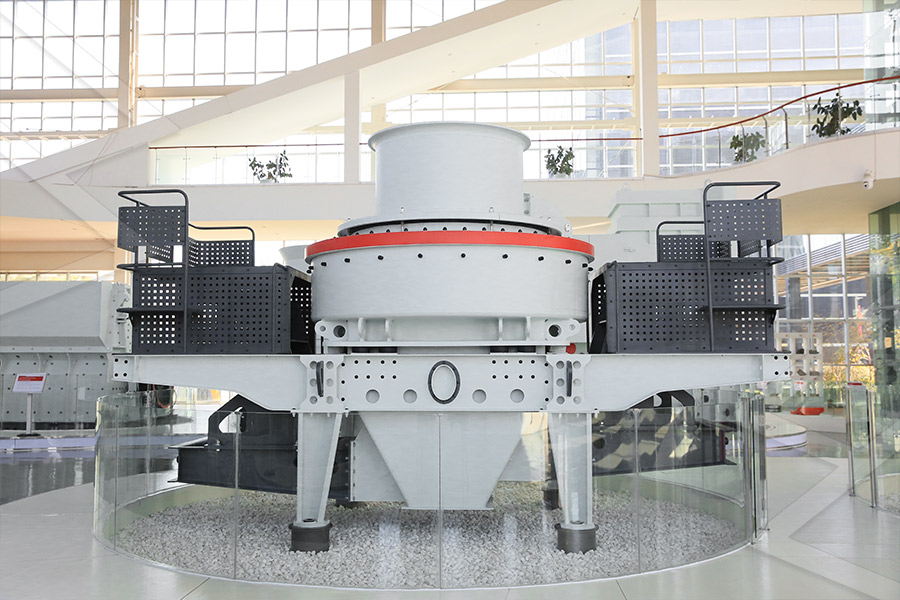

VSI Crushers

Mobile Crushers